Sep 10, 2021

Investor Demand for Treasury Auctions Blunts Taper-Tantrum Fears

, Bloomberg News

(Bloomberg) -- Investor appetite for Treasury debt auctions keeps rising even as the Federal Reserve -- which has been buying $80 billion a month for more than a year -- appears to be on the brink of tightening its purse strings.

Thursday’s 30-year bond auction was merely the most dramatic example. With yields near the lowest levels of the day at the 1 p.m. New York time bidding deadline, the $24 billion auction nonetheless drew a yield nearly two basis points lower than its pre-auction level -- a sign that demand exceeded dealers’ expectations. And primary dealers were awarded their lowest-ever share of a 30-year bond auction as other categories of bidders were willing to pay higher prices.

Across the Treasury curve, the primary dealer share of most auction tenors has been in decline, despite record auction sizes. The August two-year note and the September three-year produced the second-lowest allotments on record. The primary-dealer share of the August and September 10-year auctions were the two smallest ever.

Investor demand for Treasury auctions provides some reassurance that -- unlike in 2013, when the Fed’s signal it was moving toward reducing its bond purchases roiled markets worldwide -- the bond market is prepared for the U.S. central bank to follow the European Central Bank. The ECB this week announced it will slow the pace of its pandemic bond-buying program next quarter.

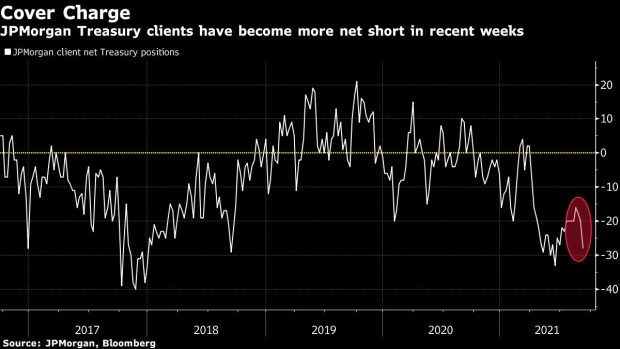

It may be that Treasury auctions are providing investors with efficient opportunities to cover short positions, which have been growing, supported by evidence of economic recovery. JPMorgan Chase & Co.’s latest Treasury client survey found the biggest net short position in almost three months.

Alternatively, it may be a signal that confidence in the recovery is beginning to fade and that a tapering signal may be further off than the Sept. 22 Fed policy meeting. In Treasury options this week, the stand-out flow was a wager that the 10-year note’s yield will reach 1.25% by Sept. 24, a decline of nearly 10 basis points. It cost an eye-popping $17 million in premium, a sign of strong conviction.

©2021 Bloomberg L.P.