Dec 7, 2021

Investors Bet $1.5 Billion on a Big Tech Stock Rebound

, Bloomberg News

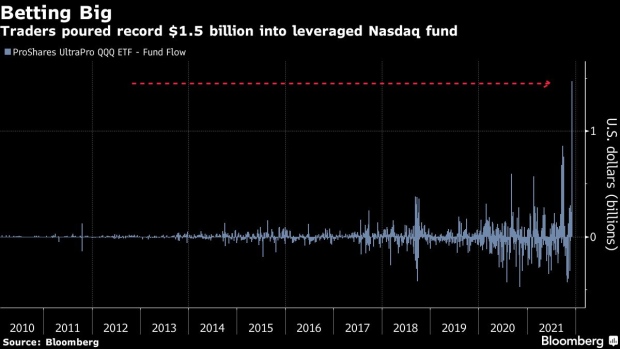

(Bloomberg) -- The stock market rebound is good news for ETF traders who’ve sunk a record $1.5 billion on a high-octane tech bet.

With Nasdaq 100 Index futures rallying again Tuesday, it looks like vindication for investors who poured into the ProShares UltraPro QQQ ETF (ticker TQQQ) en masse in the Friday rout.

The fund, which uses options to deliver three-times the benchmark’s performance, is among market leaders in early trading Tuesday after cratering last week thanks to the Federal Reserve’s hawkish tilt and concerns about the omicron variant.

Flow data, which arrives with a one-day lag because of the way the fund settles, showed investors added an unprecedented $1.47 billion at the end of last week. More than $13 billion of shares in TQQQ had changed hands in the session as it slumped 5%.

Higher interest rates make so-called growth stocks less appealing because much of their value is linked to potential future earnings, which are less attractive if yields are high or rising. Nonetheless, betting against the tech giants has rarely paid off. The likes of Apple Inc. and Microsoft Corp. still dominate their industries, while investors often rush to the safety of the mega caps at times of economic doubt.

As a leveraged fund, TQQQ is intended for short-term trading. Yet such is the power of Big Tech, an investor who stayed put in the last five years would have seen the ETF return almost 1,400%.

The Nasdaq 100’s gains on Monday lagged other major U.S. equity gauges, but thanks to its leverage the TQQQ fund jumped 2.3%. With futures for the tech index 1.8% higher at 7:39 a.m. in New York on Tuesday, the ETF surged 5.4% in premarket trading.

©2021 Bloomberg L.P.