Mar 8, 2023

Investors Bet on Europe’s Inflation Matching US in Echo of Financial Crisis

, Bloomberg News

(Bloomberg) -- The risk of persistently high inflation is starting to upend some of the basic assumptions in markets.

One of those longstanding truths is that US inflation is generally higher than Europe. That’s been the case for decades as the American economy, powered by Silicon Valley success stories and deep financial markets, expanded rapidly and Europe lagged behind.

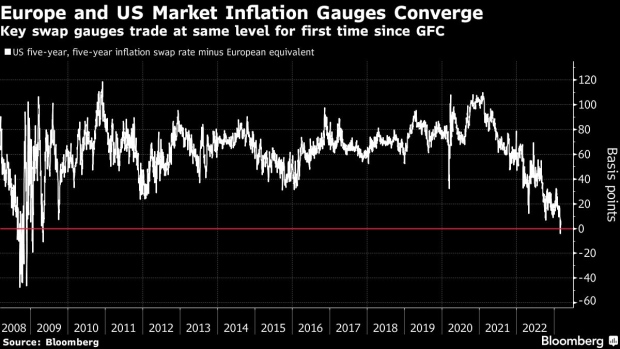

But now, market-based measures suggest that traders are starting to alter some of those beliefs. A proxy for inflation expectations in the euro area in the second half of the next decade, essentially a very long-term snapshot, is about 2.5%, roughly in line with the US. It’s the first time since the global financial crisis that began in 2008 that the two metrics, called the five-year, five-year forward inflation swap rate, have converged.

That suggests investors are getting ready for a world that looks very different to the one that’s existed for a long time, and implies big shifts for both monetary policy and markets. Traders have amped up bets via derivatives on sticky inflation in the euro area, while also erasing wagers for rate cuts this year. Benchmark yields climbed to the highest levels in over a decade.

“Eurozone inflation could be more persistent,” said Morgan Stanley strategist Andrew Sheets. “But take a step back and consider just how much confidence the market used to have in the other direction. Have all those structural drivers of lower growth and inflation really gone away?”

Faster European inflation may force the region’s central bank to keep ramping up rates and potentially drive benchmark bond yields to levels that rival Treasuries, which have been consistently higher over the past decade. Although hawkish rhetoric from policy makers on both sides of the Atlantic this week helped reduce price growth expectations, swaps remain elevated and Europe’s gauge is within touching distance of the US.

Long-term measures of European price pressures lagged US equivalents for years since the global financial crisis before consumer prices last year surged to a record. Concerns around energy security and wage pressures are contributing to speculation of an inflationary regime shift.

Policy makers have been under pressure as measures of inflation expectations through tradable securities have jumped. European officials got some relief from survey data Tuesday showing consumer expectations for euro-zone inflation receded ahead of next week’s rate decision, with a half-point hike in the deposit rate to 3% all but guaranteed.

“It’s fair to say that we struggle to remember an occasion when such a relatively obscure data release brought about such a significant reaction,” said Rabobank analysts including Richard McGuire. “This highlights the importance of inflation expectations to the ECB’s rate hike path and the very subjective way in which this has to be measured.”

For now, most analysts are skeptical the convergence of US and European inflation risk can persist. Evelyne Gomez-Liechti, a rates strategist at Mizuho, sees the European gauge falling in the medium-term.

“I don’t think we are in a change of regime where EUR inflation expectations permanently stay where the USD expectations are,” she said. “That said, in the short term, the spread may continue to be very narrow.”

--With assistance from Alice Gledhill.

(Updates with context on inflation and rates throughout.)

©2023 Bloomberg L.P.