Jan 26, 2022

Investors Grab Shortest Debt on Offer as Shield From Rate Hikes

, Bloomberg News

(Bloomberg) -- The shorter the better is the mantra for debt investors protecting themselves from the wild volatility in markets so far this year.

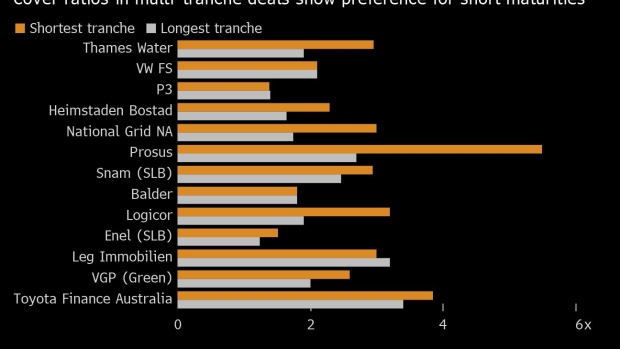

In offerings of two or more investment-grade bonds from the same company, shorter tenors typically scored a higher volume of orders relative to the amount issued, based on data compiled by Bloomberg. Companies are having to offer bigger sweeteners to flog their longer bonds.

This preference for short-dated bonds comes as investors are keen to weed out risk in what is turning out to be one of the most volatile starts to the year for corporate bonds in decades. Longer maturities are more exposed to fluctuations as the Federal Reserve gets set to hike U.S. interest rates to tackle persistently high inflation.

“We prefer shorter duration,” said Kshitij Sinha, a portfolio manager at Canada Life Asset Management, which oversees about 40 billion pounds ($54 billion). “It is tricky at the moment. Volatility has picked up and now it’s about waiting for the right valuations to deploy cash.”

Longer company bonds are seeing outsized losses as traders bet on several Fed hikes this year. Sinha is mainly concerned about rate risk but is more positive on companies’ fundamentals, and looks to “pick up spread in names we like.”

A Bloomberg index tracking euro-denominated corporate bonds with at least 10 years left to maturity has suffered a loss of 1.2% this year. By contrast, a three to five-year euro corporate index is down just 0.3%.

The prospect of mark-to-market losses almost as soon as new issues hit the secondary market has made portfolio managers more demanding. New issue premiums, an indicator of how much cheaper a newly-minted bond is compared to the borrower’s existing debt, has more than doubled year-on-year, based on data compiled by Bloomberg.

Read more: Credit Investors Demand Sweeteners as They Face Sliding Prices

Investors who steer clear of longer bonds to dodge interest-rate risk are also losing the wider credit spreads and meatier new-issue premiums found there. But the prospect of monetary policy tightening outweighs the benefits.

“We’ve been advocating that investors stick to the belly of the curve for a long time now,” said Max Blass, European credit strategist at Morgan Stanley. “Rising yields should ultimately be good for credit and as we go through the year we may think about advising longer duration, but we’re still in a transition phase of higher volatility.”

©2022 Bloomberg L.P.