Mike Cagney’s Figure Technology Taps Tannenbaum as Its New CEO

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

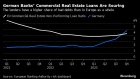

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Jun 11, 2021

, Bloomberg News

(Bloomberg) -- Nightingale Properties and Wafra Capital Partners have lined up $500 million to redevelop 111 Wall Street, a bet on office demand in Manhattan’s battered financial district.

Wafra, a Kuwaiti-backed wealth fund, and New York-based Nightingale acquired the 25-floor building and the land beneath it last year in separate transactions. The firms took advantage of Covid-reduced prices, according to Newmark executive Dustin Stolly, who helped arrange the financing.

The financial district has suffered an exodus of tenants that was exacerbated as the pandemic emptied Manhattan skyscrapers. The new financing, for the acquisition and renovation of the Wall Street building, comes as companies start to call workers back to the office.

“It’s a testament to capital markets and their sponsorship of the recovery in New York,” Stolly said. “This is the first large-scale construction loan since Covid.”

Wafra and Nightingale paid $175 million in January 2020 for the building and bought the land in July, according to New York City property records.

Stolly, who arranged the financing with partner Jordan Roeschlaub, declined to name the lenders, citing a confidentiality agreement.

The loan will fund a gut renovation to create 1.2 million square feet (111,000 square meters) of space that will rent at a discount to comparable properties in midtown, Stolly said. The offices will be ready for occupants in about two years.

Even as New York starts to bounce back, the demand for office space is unclear. While companies that embraced remote work are making plans to bring people back to Manhattan, flexible schedules could mean firms need less space.

The office availability rate in Manhattan rose for a 12th consecutive month in May to 17%, according to a report by Colliers. Since the pandemic started last March, the amount of space up for grabs jumped 70% to a total of 92 million square feet. Only about 18% of workers in the New York area had returned to desks as of June 2.

Lower Manhattan has had a high office vacancy rate for years as financial firms moved away from the home of the New York Stock Exchange and Federal Reserve. Citigroup Inc. left 111 Wall Street when its lease expired in 2019. Deutsche Bank AG is moving from nearby 60 Wall Street to One Columbus Circle, the former Time Warner Center, now renamed Deutsche Bank Center

(Updates with name of Newmark partner and price of building starting in fifth paragraph.)

©2021 Bloomberg L.P.