Jun 24, 2021

Investors Who Want In on Korea’s Hot IPOs Find a Risky Route

, Bloomberg News

(Bloomberg) -- Investors craving a slice of South Korea’s sizzling initial public offerings are taking an unlikely route via junk bonds to steal a march on their rivals.

They are rushing into high-yield debt funds that also invest in IPOs. While many funds worldwide park their money in both bonds and shares, and some invest in IPOs, the Korean products are unique in that the government gives them preferential access to equity offerings.

The funds let individual investors seek better returns but also expose them to elevated risks, at a time when households are already saddled with record debt as they increase leverage to buy homes, stocks or cryptocurrencies. But in a red-hot market that saw, for example, retail orders earlier this year for SK Bioscience Co.’s IPO exceed the supply by more than 300 times, the products lure investors as an easier way to get exposure to newly listed stocks.

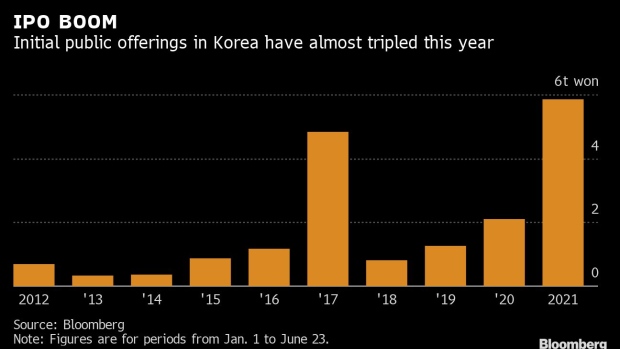

The nation’s IPO market is one of the hottest in the world now as the Kospi share index hits record highs, with deals syndicated in Korea almost tripling so far this year to 5.8 trillion won ($5.1 billion), according to Bloomberg-compiled data. The funds are entitled to get up to 5% combined of the allocation in IPOs.

Authorities introduced those products in 2014 to entice investors to buy junk debt after a string of corporate failures chilled market sentiment.

Funds that invest solely in IPOs also exist in Korea, but stiff competition means that they may not be able to buy new shares that they desire. That puts the bond funds at an advantage because they have preferential access to IPOs.

KTB Asset Management Co. is a Seoul-based firm that’s one of the biggest managers of the IPO-linked bond funds with 950 billion won in assets under management. About 45% of the funds are invested in high-yield notes, and they’ve returned 10.2% in the past year. The products need to put at least 45% of their funds in bonds rated below A- or in small-cap Konex-listed stocks.

“Considering that there are planned IPOs by several solid firms in the second half, we expect steady cash inflows and good returns for such funds,” said Woo Hyungjin, head of fixed income division at the firm.

Companies including LG Chem Ltd.’s battery unit LG Energy Solution are preparing IPOs at home in the second half.

Assets held by Korea’s IPO-tied bond funds have more than doubled since the end of 2020 to 1.8 trillion won, according to data provider KG Zeroin Co. That’s helped drive sales of notes rated BBB+ or below in the first half to the most since 2015, Bloomberg-compiled data show. Spreads on BBB+ rated corporate notes have tightened 16 basis points this year, compared with a 7 basis-point decline in AA- graded debt.

“Demand for BBB rated bonds will continue to stay strong in the second half,” said Kim Eun-gie, credit analyst at Samsung Securities Co. in Seoul, though adding that investors have been picky about which high-yield notes to buy amid market volatility.

©2021 Bloomberg L.P.