Mar 2, 2023

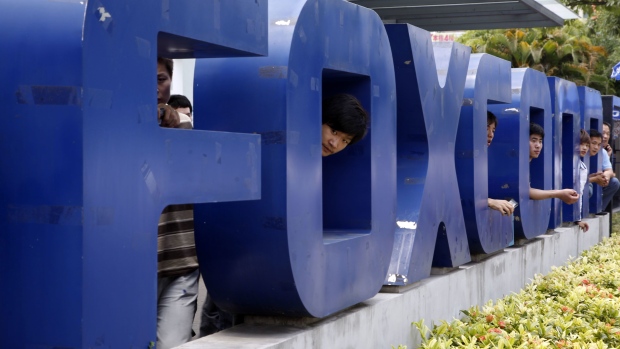

IPhone Maker Plans $700 Million India Plant in Shift From China

, Bloomberg News

(Bloomberg) -- Apple Inc. partner Foxconn Technology Group plans to invest about $700 million on a new plant in India to ramp up local production, people familiar with the matter said, underscoring an accelerating shift of manufacturing away from China as Washington-Beijing tensions grow.

The Taiwanese company, also known for its flagship unit Hon Hai Precision Industry Co., plans to build the plant to make iPhone parts on a 300-acre site close to the airport in Bengaluru, the capital of the southern Indian state of Karnataka, according to the people, who asked not to be named as the information is not public.

The factory may also assemble Apple’s handsets, some of the people said, and Foxconn may also use the site to produce some parts for its nascent electric vehicle business. Apple declined to comment.

The investment is one of Foxconn’s biggest single outlays to date in India and underscores how China’s at risk of losing its status as the world’s largest producer of consumer electronics. Apple and other US brands are leaning on their Chinese-based suppliers to explore alternative locations such as India and Vietnam. It’s a rethink of the global supply chain that’s accelerated during the pandemic and the war in Ukraine and could reshape the way global electronics are made.

Hon Hai Chairman Young Liu, who met India’s Prime Minister Narendra Modi this week, did not comment on a possible Karnataka investment in a statement on Saturday outlining his visit.

“My trip this week supported Foxconn’s efforts to deepen partnerships, meet old friends and make new ones, and seek cooperation in new areas such as semiconductor development and electric vehicles,” Liu said. “Foxconn will continue to communicate with local governments to seek the most beneficial development opportunities for the company and all stakeholders.”

The new production site in India is expected to create about 100,000 jobs, the people said. The company’s sprawling iPhone assembly complex in the Chinese city of Zhengzhou employs some 200,000 at the moment, although that number surges during peak production season.

Output at the Zhengzhou plant plunged ahead of the year-end holidays due to Covid-related disruptions, spurring Apple to re-examine its China-reliant supply chain. Foxconn’s decision is the latest move that suggests suppliers may move capacity out of China far faster than expected.

What Bloomberg Intelligence Says

The plan may herald an accelerated relocation from China for Hon Hai. Once completed, we calculate this factory could materially improve the component supply in India and potentially boost the country’s share of iPhone assembly to 10-15 % from a sub-5% currently.

— Steven Tseng and Sean Chen, analysts

Several government officials including India’s deputy tech minister tweeted confirmation of details around the upcoming plant on Friday, including that it will be built soon and create 100,000 jobs.

The plans could still change as Foxconn is in the process of finalizing investment and project details, the people said. It’s also unclear if the plant represents new capacity, or production that Foxconn is shifting from other sites such as its Chinese facilities.

The Karnataka state government also did not respond to a Bloomberg request for comment. Liu has committed to another manufacturing project in the neighboring Telangana state.

Foxconn’s decision would be a coup for Modi’s government, which sees an opportunity to close India’s tech gap with China as Western investors and corporations sour on Beijing’s crackdowns on the private sector.

India has offered financial incentives to Apple suppliers such as Foxconn, which began making the latest generation of iPhones at a site in Tamil Nadu last year. Smaller rivals Wistron Corp. and Pegatron Corp. have also ramped up in India, while suppliers such as Jabil Inc. have begun making components for AirPods locally.

--With assistance from Mark Gurman.

(Updates with Hon Hai statement in fifth paragraph)

©2023 Bloomberg L.P.