Feb 1, 2023

IPOs Speed Up Their Timelines as Bankers Start to See Go Signals

, Bloomberg News

(Bloomberg) -- Bankers are pushing to accelerate plans for US IPOs as the market kicks off the year with a series of encouraging signs.

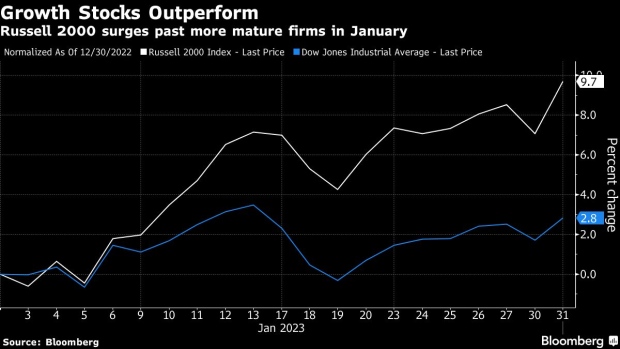

Evidence is mounting that the Federal Reserve is successfully combating inflation. Growth stocks are outperforming, while secondary offerings are posting stronger returns. And, the Cboe Volatility Index, a closely watched measure of risk tolerance, touched its lowest level in a year in January and closed Tuesday below the critical 20 handle.

Signals like these, alongside direct talks with investors, have created opportunities to speed up timelines for certain deals, said Steve Maletzky, head of equity capital markets at William Blair & Co.

“That’s what we’re advising our clients who are already in the IPO pipeline and fit the criteria that investors are focused on in today’s market: companies that have proven commercial scale and strong top-line growth in addition to proven profitability,” he said in an interview.

Dealmakers had been anticipating that it will take until the second half of 2023 for IPOs to rebound in earnest from their lightest year in three decades. Now, they’re rethinking that expectation.

Reopening New York’s IPO market isn’t just critical for the laundry list of candidates waiting in the pipeline. It would also help the broader economy avoid or minimize a potential recession. IPO proceeds are typically used to create jobs, repay debt, advance medical research and fund acquisitions.

A revival in new listings would also bring more clarity about the health of corporate balance sheets and a much-needed revenue boost for bellwethers atop the financial sector.

Deal Flow

A key signal is coming from the growth stocks that tend to dominate the IPO market. The tech-heavy Nasdaq 100 Index surged 11% in January, while Russell 2000 Index jumped almost 10% in January, compared with a 6.2% gain in the S&P 500 Index. Secondary offerings are also improving from the start of 2022, a sign of stronger demand from many of the same investors who participate in IPOs.

However, the coast isn’t fully clear, as deal flow remained muted in January despite the improving returns. Just nine IPOs got priced in the month, raising a total of $483 million, according to data compiled by Bloomberg. More than 50 secondary offerings raised a total of $5.4 billion, in-range with last year’s depressed levels.

The next tea leaf for the dealmaking outlook could arrive as soon as Wednesday afternoon, when Federal Reserve officials announce their next decision on interest rates and Chair Jerome Powell addresses the central bank’s policy path.

“While the VIX is now sub-20 and maybe companies are settling into their current valuation, the bigger challenge remains the uncertainty as to the macro backdrop and to earnings going forward,” Mizuho Americas head of investment and corporate banking Michal Katz said in an interview. “That’s what is going to put a cap on equity issuance more broadly in the near term.”

©2023 Bloomberg L.P.