Aug 21, 2019

Ironman Race Owner Wanda Sports Draws in Wall Street Bulls

, Bloomberg News

(Bloomberg) -- Wanda Sports Group Co. -- a global sports marketing firm and event promoter -- has nabbed the interest of Wall Street bulls, suggesting it could be the next tech and media darling, and further indicating the growth in investor demand for Chinese stocks.

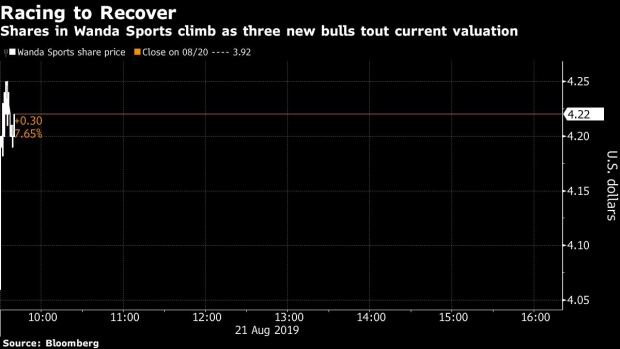

American depository receipts in the Beijing-based company rose as much as 8.4% in New York on Wednesday as at least three investment banks initiated the stock with buy-equivalent ratings. Deutsche Bank began its bullish call by setting a Street-high target price of $11, adding that the company is “well positioned for growth" in a “highly fragmented industry offering substantial organic and inorganic growth opportunities."

Wanda Sports, which owns the organizer of the Ironman triathlon race, began trading on the Nasdaq in late July. While the company has lost more than half of its market value since its debut, Morgan Stanley sees the company as a "distinctive asset at [a] distressed valuation."

The fast-growing global sports industry has Morgan Stanley optimistic, and Wanda Sports’ portfolio of mass participation and spectator events worldwide “are relatively resilient amid macro uncertainties." The firm began coverage of the stock with an overweight rating and $8 target.

Joining in the bullish sentiment, Citigroup also set a buy rating for Wanda Sports, which is a unit of Chinese conglomerate Dalian Wanda Group Co.

To contact the reporter on this story: Kamaron Leach in New York at kleach6@bloomberg.net

To contact the editors responsible for this story: Catherine Larkin at clarkin4@bloomberg.net, Morwenna Coniam

©2019 Bloomberg L.P.