Apr 25, 2022

Is it time to buy bonds again? What's the alternative?

By Larry Berman

Larry Berman's Educational Segment

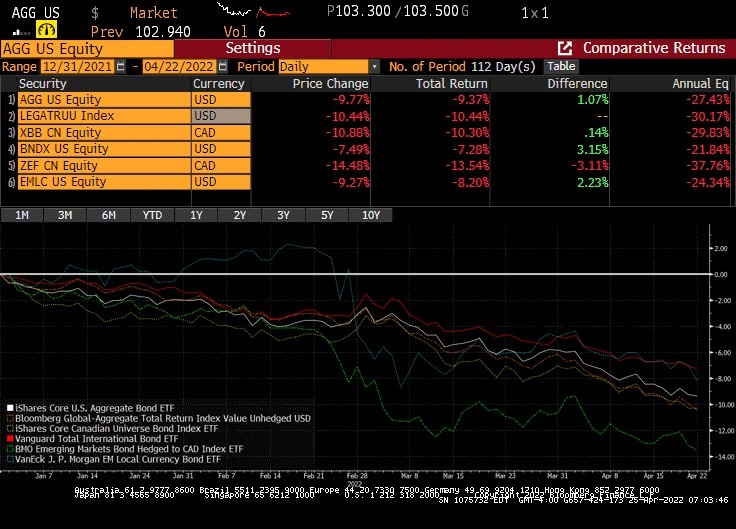

The global bond market has had the worst start to the year in, well, forever. I think it was worse in the early 1980s when Paul Volker was trying to crush inflation, but the total return indexes I have access to do not go back that far. This was inevitable, of course, as there really is a lower bound in terms of interest rates despite the fact that a huge percentage of debt globally traded with a negative yield in recent years. In the past few weeks, I’ve started to add more duration (interest rate risk) to my bond holdings. Let’s see why I think we are close to an interest rate inflection point.

Looking back at the period of NIRP and ZIRP (negative and zero interest rates) since 1999, we see two bands of post crisis yield highs. Following the dot com bust and 9-11 in the early 2000s, long bond (30-year) yields peaked at a bit over 5 per cent. The second range started when yields first toughed after the GFC (Lehman bankruptcy) and then the European debt crisis (2012) and Brexit (2016) below the 2.5 per cent range and had trouble holding above 3.25 per cent on subsequent selloffs. During the last FOMC tightening cycle (2017/2018), the stock market forced the FOMC to start to cut rates again in 2019 and rates could not get much higher. We are now testing the yield range above three per cent. So what needs to happen to push yields up to the next band around five per cent? Inflation being more persistent is the big risk. I could not imagine, given the leverage in the economy and with all the outstanding debt, that the economy can handle much higher yields. There is a good debate to be had that the economy would collapse well before it got there. This is why I’ve been starting to add duration to my bond holdings.

What most investors are likely doing now is looking at the returns in bonds to start the year and saying (yuck—or something worse) and looking for alternatives. Make no mistake, I think traditional fixed-income is a broken asset class and will not likely serve investors well in an cycle of higher inflation. But there will be periods, where in a recession, they should offer the traditional counterbalance to equities in your portfolio. We are likely getting close.

Investors need to learn about investing in the private credit markets. As it turns out, there are alternatives to traditional bonds. They are just harder to get exposure to for the average DIY investor. Recognizing this issue, I launched an alternative private debt and equity fund 2 years ago that focuses on extracting yield and income with a bit of growth from lending in several private asset classes like secured mortgages and bonds to residential, commercial and corporate borrows. The fund is only available to private clients of www.QWealth.com partners and is not publicly available.

Commercial, residential mortgage and asset backed securities as well as public mortgage investment corps are not new asset classes. In recent years, the private mortgage and lending business has taken off in a big way. The whole area of shadow banking (traditional banking is reducing exposure to many lending areas) is a great asset class that investors need to know more about. The biggest players in this space in Canada are the business development corps backed by the government of Canada. Investors can see net yields in the five-10 per cent range are achievable with significantly less volatility than in public high yield credit markets. Not necessarily less risk, but often less risk with less volatility. This point is important. For the more stable price return, you typically give up significant liquidity. Some of these private loans have lock up periods of several months to several years. But that’s not much different than a GIC when you think about it, so it should not scare investors. There are a few public options for the private credit markets, but that does not solve the public market volatility issue that is currently scaring traditional bond investors.

The chart above shows a relatively new (three years) private credit ETF (VPC) that invests in public business development corps (BDCs). I’ve also included a Canadian and US example of a mortgage investment corp (AN – Atrium, BXMT - Blackstone). As you can see, there was huge volatility in their price returns during the COVID shock.

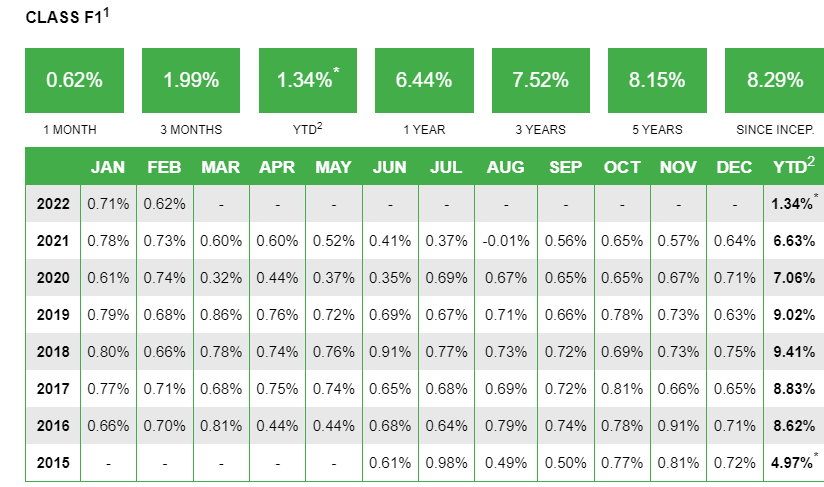

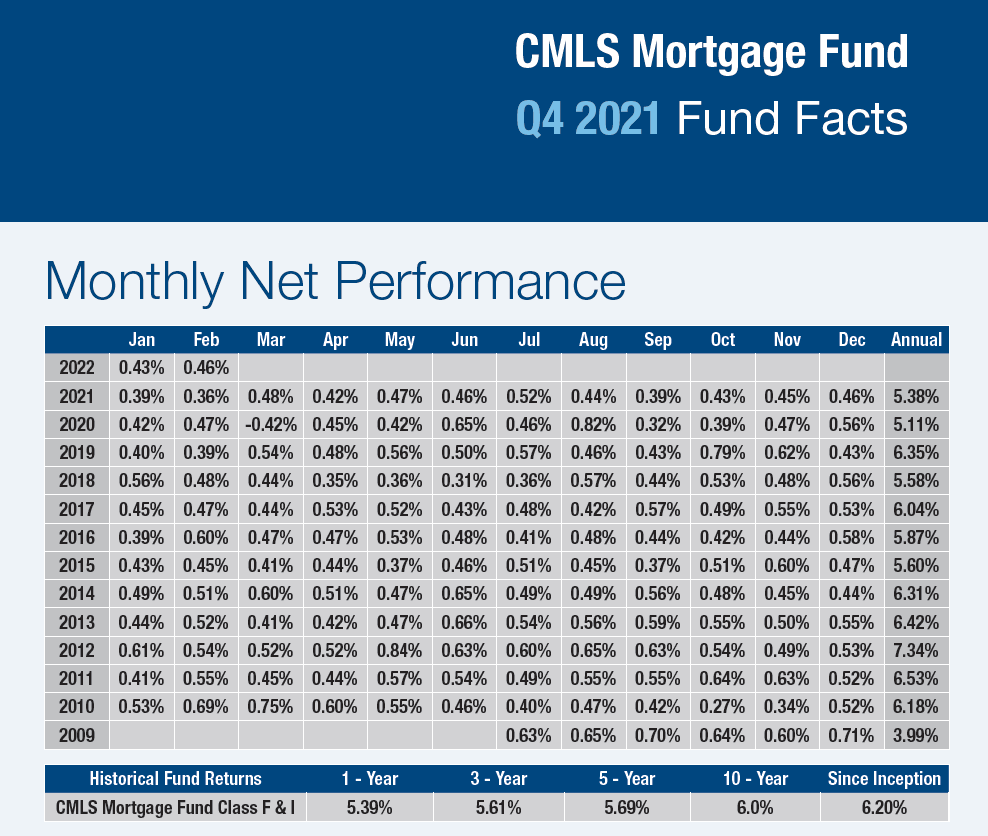

Here is an example of the return profile of a private BDC. This is one we own in our QWealth fund offered by Next Edge. Not all BDCs are reputable and lots of due diligence is needed. David Einhorn is a high-profile US investor of Greenlight Capital. He uncovered a fraud in the BDC market 20 years ago, it’s a great read for those looking to understand the private lending sector a bit better. The second table is another fund we own offered by a private mortgage investment corp CMLS Financial | Canada's Mortgage Company we own in the fund too. You can see the stability in the returns and yields they offer. Some have NAVs that are marked to market and others have fixed NAVs like a money market investment would have.

The final week (April 28 at 7 p.m. ET) of our Spring 2022 virtual roadshow will feature a deep dive into the private credit asset class. We think investors need to take a close look at the sector for their fixed income needs. Keep an eye on The Investor’s Guide to Thriving website for more information on how to sign up for notifications. If you have learned a few things over the years from our educational segments, please consider supporting one of my favourite charities. Dementia and Alzheimer’s research at the Baycrest Hospital/Rotman Research Institute is world class. Each year I raise money for this cause and match all BNN Bloomberg viewer donations. In the past nine years we have raised almost $500,000 thanks to you. Please consider sponsoring here.