Jun 20, 2020

Israel’s Bezeq Sees Scope for National Fiber Rollout This Year

, Bloomberg News

(Bloomberg) -- Israel’s largest telecommunications company could be on the verge of wrapping up years of disputes with regulators, paving the way for it to start rolling out its fiber optic network this year on a national scale.

Bezeq Israeli Telecommunication Corp. has so far only deployed high-speed internet in limited locations because it couldn’t agree with the Ministry of Communications on how to reach a majority of the country in an economically viable manner. A years-long corruption probe into alleged favoritism of the company by Prime Minister Benjamin Netanyahu kept Bezeq from reaching an accord with regulators, as did political paralysis from a series of caretaker governments starting in December 2018.

But after Israel formed a government last month and appointed Yoaz Hendel to lead the ministry, the regulator has signaled that it wants to “move forward” on this issue, according to Bezeq Chief Executive Officer David Mizrahi.

In an interview in his Tel Aviv office, when asked if the company could start deploying its fiber network across the country this year, he said, “now that there is a minister, I hope things will move faster. We’re trying to keep a certain level of optimism.”

Bezeq is asking the ministry to let it pay competitors to pass its cables through their fiber infrastructure, in order to speed up deployment at a cheaper cost, Mizrahi said. Rival telecom companies are currently allowed to use Bezeq’s slower network in just this way.

A spokesman for the communications ministry said last week it will soon issue a directive on sharing fiber infrastructure in residential buildings that will apply equally to all companies.

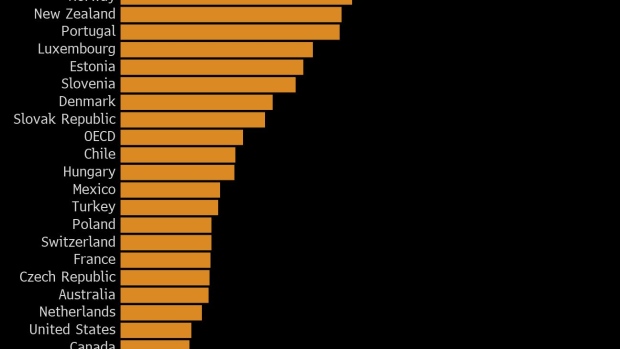

Israel lags most developed nations in terms of fiber deployment, leaving its economy under-prepared for the next wave of consumer trends that will run on high-speed connections, such as internet-connected home appliances. Slower connections also hamstring the ability of technology firms to rapidly store and transfer big data troves, which impedes growth for the main driver of the country’s economy.

Bezeq already offers fiber to corporate clients and has done a lot of legwork for mass deployment, with its fiber-optic cables laid out close to 100,000 buildings, or about 60% of the country. What’s left is connecting to each of those households, which will take between five and six years and “billions of shekels” of investment, Mizrahi said. The remaining 40% of the country is spread across about 900,000 buildings, he said.

Profitability in Israel’s telecommunications market has continuously shrunk since the government tweaked regulations almost 10 years ago to boost competition. The ensuing price wars became so intense that investors worried about the financial collapse of some of the telecom companies.

Some of that sentiment was reversed after Israeli authorities approved the merger between two cellular providers this month, feeding speculation that companies may start lifting mobile prices.

Mizrahi said he doesn’t expect a “dramatic change” in mobile prices as a result of the tie up between Cellcom Israel Ltd. and Golan Telecom Ltd., which leaves Israel still with five operators instead of six.

“There are enough competitors and there are no barriers to switching carriers,” Mizrahi said.

©2020 Bloomberg L.P.