Aug 22, 2022

Israel Set for Longest Cycle of Rate Hikes Since 2008: Day Guide

, Bloomberg News

(Bloomberg) --

Israel’s central bank surprised most economists by delivering its biggest increase to interest rates in two decades, tightening monetary policy for the fourth straight meeting in the face of the fastest inflation since 2008.

The monetary committee on Monday increased its benchmark to 2% from 1.25%. The decision makes this the longest cycle of rate hikes since 2008, and is the third to exceed forecasts since the tightening cycle began earlier this year.

“The Israeli economy is recording strong growth, accompanied by a tight labor market and an increase in the inflation environment,” the central bank said in a statement. “The increase in inflation is broad-based, with contributions from most CPI components.”

The shekel, which is closely correlated with the performance of US equities, extended losses after the rate announcement and traded about 0.8% weaker against the dollar as of 6:16 p.m. in Tel Aviv.

Governor Amir Yaron is looking to navigate an increasingly buoyant domestic economy that’s ripe for higher rates but with inflation likely constrained by a surge in the shekel and a letup in global energy prices.

The central bank has tried to get ahead of inflation by increasing the pace of monetary tightening every time it raised rates this year. Price growth has been above the government’s 1% to 3% target since January.

“It’s the right step, because inflation is really far from the target and the interest rate is very low,” said Alex Zabezhinsky, chief economist at Meitav DS Investments Ltd.

Zabezhinsky, who was one of two analysts to predict Monday’s decision, said the benchmark will likely rise to 2.75% by the end of the year. He sees a more modest half-percentage point hike at the next decision in October.

The central bank’s research team has said the key rate will only reach 2.75% in the second quarter of 2023.

‘More Tightening’

Forward guidance by policy makers dropped “any dovish caveats,” according to Citigroup Inc., which now expects a 75 basis-point increase at the next meeting and possibly another move of the same magnitude in November.

“The tone of the statement was measured and calm, but leaves us in no doubt that more tightening is in store,” Citigroup economist Michel Nies said in an note to clients.

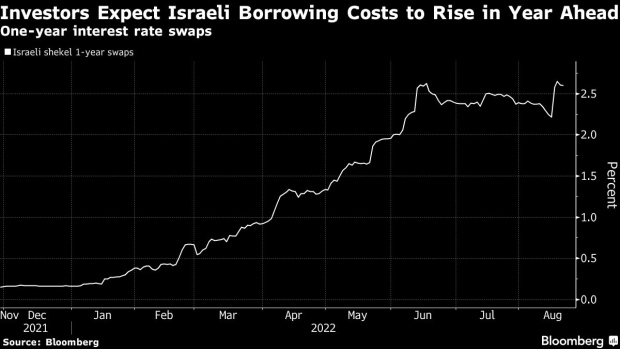

Markets also see scope for much higher borrowing costs ahead. One-year interest rate swaps are pricing in an increase to around 2.9% a year from now.

An economic upswing in Israel has propelled output and consumption to levels last seen before the pandemic.

The shekel has also staged a comeback since the start of July in what’s been the world’s second-biggest appreciation against the dollar during the period.

For much of the first half, however, declines in the Israeli currency fed into inflation by raising the cost of imports.

The central bank’s research department issued revised forecasts in July that lifted this year’s estimate for inflation to 4.5%, an increase of a full percentage point from April’s projections.

Last month, price growth topped all forecasts and accelerated to 5.2% on an annual basis, the fastest since October 2008.

The decision on Monday showed the Bank of Israel is trying to remain in sync with its counterparts in the US, according to Jonathan Katz, macro strategist for Leader Capital Markets, who said Yaron “believes in front-loading” the rate hikes.

The Federal Reserve has embarked on an increasingly aggressive path of monetary tightening to lower inflation from levels that are at 40-year highs. The Fed raised its benchmark by three-quarters of a percentage point at its July policy meeting, following an increase of the same size the month before.

Israel’s larger-than-expected hike “underlines the hawkish character of the monetary committee and especially our governor,” Katz said.

(Updates with economist comments starting in 10th paragraph)

©2022 Bloomberg L.P.