Oct 3, 2022

Israel to Keep Hiking Rates at Pace Unseen in Decades

, Bloomberg News

(Bloomberg) --

Sign up for our Middle East newsletter and follow us @middleeast for news on the region.

Israel’s central bank raised interest rates to the highest since 2011 and signaled more hikes ahead as part of what’s now its longest cycle of monetary tightening in decades.

With inflation above target and the shekel at the weakest in more than two years, policy makers on Monday increased their benchmark for the fifth time in a row to 2.75% from 2%. The decision to hike by 75 basis for the second straight meeting was in line with the forecasts of most economists surveyed by Bloomberg.

The central bank is “front-loading” rate hikes because it’s “determined to return the inflation rate to within the target range,” Governor Amir Yaron told reporters after the decision.

“To deal with the rise in inflation, we on the Bank of Israel’s Monetary Committee continue to move forward with the process of monetary contraction, while taking measured steps and examining the range of economic developments in Israel and worldwide,” Yaron said.

Israel’s currency, which was down as much 1.4% against the dollar earlier on Monday, erased losses and traded 0.3% stronger as of 5:35 p.m. in Tel Aviv.

The decision shows the Bank of Israel is trying to remain in sync with its counterparts at the US Federal Reserve by acting aggressively to keep inflation in check. As recently as in July, the central bank’s research department predicted the key rate would only reach 2.75% in the second quarter of 2023.

Alongside the rate announcement on Monday, the central bank’s research team also issued updated economic forecasts, forecasting stronger economic growth and slightly faster inflation this year. The department projects gross domestic product expanding 6% in 2022, up from its previous outlook for a 5% gain.

Price growth is now seen at 4.6% this year before slowing to within the government’s 1% to 3% target and reaching 2.5% in 2023. It expects the benchmark rate at 3.5% a year from now.

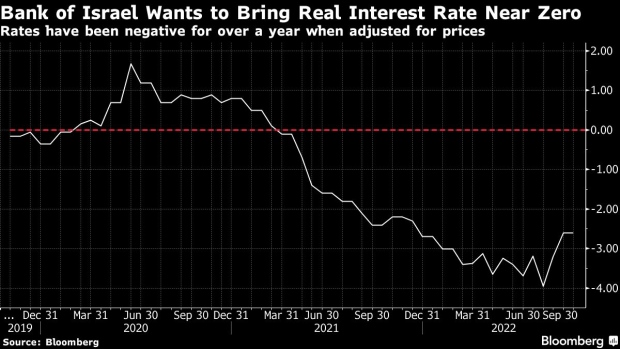

Yaron still has a long way to go before delivering on his goal of bringing inflation-adjusted interest rates to “around zero, or slightly above it.” By that measure, Israel’s rate buffer hasn’t been positive in more than a year.

Israel’s one-year currency swaps suggest investors see the base rate rising to around 3.7% a year from now.

Inflation Outlook

In a sign the urgency for the central bank to act is subsiding, Yaron said on Monday that medium- and long-term price expectations in Israel are already within the target, while inflation sentiment over the short term is around the upper bound of the goal.

Price growth slowed more than anticipated in August to an annual 4.6%, following a decline in the global cost of oil and Israel’s temporary cut in the excise duty on fuel.

But currency depreciation has been a concern. The shekel, which is closely correlated with the performance of US equities, has dropped as American stocks suffered their worst monthly rout since March 2020.

After weakening for much of the first half of the year, the Israeli currency rallied between July and mid-August but has since slumped sharply. Declines in the shekel threaten to add to price pressures by making imported goods more costly.

“The risk is that if the recent FX weakness extends, this could imply that inflation will remain above the Bank of Israel’s target for longer,” Goldman Sachs Group Inc. analysts including Clemens Grafe said before the decision on Monday.

“Reflecting these developments, in the near-term and in the current market environment we continue to think that external developments will remain the main drivers for monetary policy and the rates market in Israel,” they said.

©2022 Bloomberg L.P.