May 23, 2018

Israeli Bourse Aims at Tech Startups With Singapore Connection

, Bloomberg News

(Bloomberg) -- Israel’s flagship bourse is partnering with Singapore Exchange Ltd. in a bid to keep the momentum going from last year’s IPO surge.

The Tel Aviv Stock Exchange, which saw a rebound in initial public offerings and trading volume in 2017, is working with Singapore to convince Israeli technology firms to list their shares on both exchanges. Israeli startups have largely skirted both markets, but the plan figures the lure of investment from Asia can encourage more tech companies to also trade at home, TASE Chief Executive Officer Ittai Ben-Zeev said in an interview in Tel Aviv.

The dual-listing plan is the TASE’s latest attempt to deepen Israeli investors’ links to local high-tech firms. Investment houses in Singapore have the resources and capabilities to offer competitive valuations to tech companies looking to IPO, something Israeli institutions lack, Ben-Zeev said. Some 93 percent of Israeli tech firms that undertake exits end up selling to global firms, partly because of poor valuations locally, the CEO said.

“That’s a very high number,” Ben-Zeev said. “And a great place to start.”

One firm recently went on a non-deal roadshow in Singapore and is exploring a dual-listing, he said. The TASE has drawn up a list of “a few dozen” candidates, valued at between $150 million and $400 million, to pitch the idea of an IPO on both exchanges, he said.

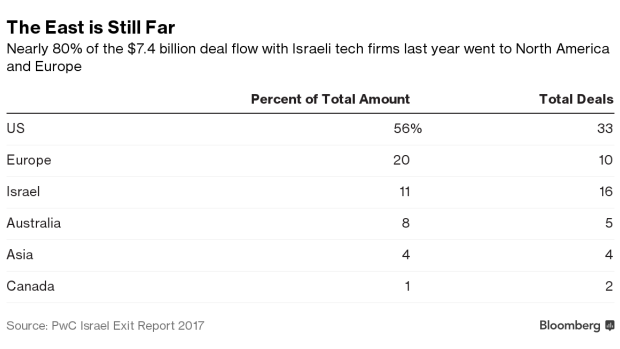

Asian investors have been steadily upping their investments in Israeli startups, with deals climbing 9 percent to $259 million last year, according to a report by PwC. Yet the amounts are still dwarfed by American funds, which have been doing business with Israeli startups over the past 30 years, according to Guy Preminger, head of PwC Israel’s technology division.

Balancing out the geographic spread of investment will take time, but many Israeli tech firms are now prioritizing Asia ahead of the U.S., especially in fields of high demand to Asian investors like robotics and semi-conductors, Preminger said.

There’s been a broad slowdown of Israeli tech IPOs in the last three years, with a flood of venture capital providing plenty of money for firms to operate. The tie-up with Singapore gives another alternative for companies when those funds dry out, Preminger said, calling it “a welcome move” because of its long-term approach.

Ben-Zeev’s turnaround strategy aims to get the TASE to better reflect the Israeli economy, whose growth is driven in part by a world-class tech industry. After six years of falling volume, activity has picked up since he took over leadership of the bourse in January 2017. There were 17 new share listings last year, the highest number since 2010, according to TASE data, and the CEO expects a higher tally in 2018.

That’s helped boost the valuation of the TASE, which will hold its own IPO in the next six months, by some 40 percent to 600 million shekels ($168 million), Ben-Zeev said. That still pales in comparison to its new partner in Asia. Singapore Exchange, whose daily turnover is roughly triple that of TASE, has a market capitalization of 8.2 billion Singapore dollars ($6.1 billion).

“Trading volume has to grow, the market cap has to grow,” Ben-Zeev said. “We have a lot more to do, and on many fronts.”

To contact the reporter on this story: Yaacov Benmeleh in Tel Aviv at ybenmeleh@bloomberg.net

To contact the editors responsible for this story: Stefania Bianchi at sbianchi10@bloomberg.net, Vernon Wessels, Michael S. Arnold

©2018 Bloomberg L.P.