Jul 13, 2020

It’s Bad for Stock Pickers If Fed Must Do More, Bernstein Says

, Bloomberg News

(Bloomberg) -- Active equity investors are likely to face a “horrible environment” if the Federal Reserve is forced to expand its balance sheet again to avert mass bankruptcies and higher unemployment, according to quantitative strategists at Sanford C. Bernstein.

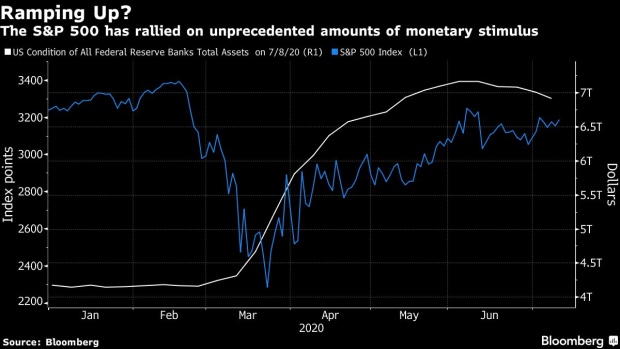

Fresh intervention may lift stocks, though the U.S. central bank will prioritize averting layoffs and corporate failures over price discovery and capital allocation, analysts including Inigo Fraser Jenkins wrote in a note dated July 13. This would cause equities to rally even further, albeit at a pace slower than that seen in March, likely putting active managers at a disadvantage, they said.

“There is an emerging possibility that the Fed hasn’t gone far enough,” the note said, adding that the central bank’s balance sheet could swell further should a bad-enough event justify it. “If that came to pass, then maybe valuation of the market simply doesn’t matter.”

Stocks have rallied on unprecedented easing from global central banks, as well as support measures from governments worldwide, as policy makers work to combat the economic pain from Covid-19. The S&P 500 and the MSCI All-Country World Index are up more than 40% from their lows in March.

©2020 Bloomberg L.P.