Mar 22, 2023

It’s Bad Timing as Japan Hosts World’s First Bank IPO This Year

, Bloomberg News

(Bloomberg) -- The listing of a Japanese online lender on March 29 will be an acid test of investor appetite for bank shares, just as turmoil in the global financial system sways markets.

While concerns over the health of the world’s banks have eased somewhat, shareholders in Tokyo-based SBI Sumishin Net Bank Ltd. still only managed to raise about $366 million this week after the shares were priced at the bottom of a range at 1,200 yen each. The bank had expected shares to price as high as 1,260 yen.

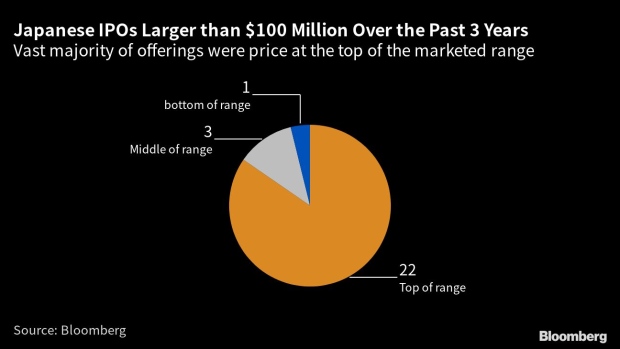

Over the past three years, the 25 listings in Tokyo that were larger than $100 million mostly priced within or at the top end of the offered range. Among banks, three had priced their shares at the top of the range in the past decade, raising a combined $5.3 billion, according to data compiled by Bloomberg.

“Unfortunately, the market timing for the initial public offering wasn’t great,” said Sumeet Singh, head of equity research, IPOs and placements at Aequitas Research Pvt. “While there isn’t much to complain about the company’s performance, the recent market turmoil has led to its peers correcting and, hence, the IPO doesn’t look as attractive anymore.”

This isn’t the first time that SBI Sumishin, a venture between SBI Holdings and Sumitomo Mitsui Trust Bank, has been beset by bad timing. It canceled an IPO in Tokyo about a year ago due to Russia’s invasion of Ukraine.

The Japanese lender initially disclosed details of the offering in a filing in Tokyo on Feb. 28, less than two weeks before the quick collapse of SVB Financial Group. Then came the Credit Suisse Group AG crisis.

Japan’s financial stocks have been at the center of a selloff in Asian banks, with the 79-member TOPIX Banks Index losing about 11% since the start of March. That’s more than seven times the drop in the broader benchmark Topix.

The fall in Japanese banking shares led to declining multiples for the sector, putting pressure on IPO prices, according to Travis Lundy, an analyst at Quiddity Advisors who publishes on Smartkarma.

“Do I think the price could have been higher than 1,200 yen if Japanese bank stocks had gone up 15% from the SBI Sumishin announcement rather than down? Yes,” Lundy said.

Apart from SBI Sumishin, there hasn’t been any other lender globally that has executed an IPO this year, according to data compiled by Bloomberg. New share sales as a whole have been scarce in traditional venues from New York to Hong Kong amid uncertainty regarding the pace of interest rate increases and persisting inflation.

©2023 Bloomberg L.P.