Feb 23, 2019

It's Hard Get Excited About Soy Acres When Trade Questions Loom

, Bloomberg News

(Bloomberg) -- When farmers and analysts get together at an annual U.S. government outlook forum, the conversation usually turns to topics like plantings and weather. This year, the hottest buzz was all about trade.

It’s hard to bank on acreage and stockpiles forecasts that were released, when in the end, all that data will depend heavily on what happens with trade negotiations between China and the U.S., said Rich Feltes, director of market insights for R.J. O’Brien & Associates.

“There is nothing here to move the markets,” Feltes said regarding data and outlooks released by the U.S. Department of Agriculture over two days at its annual outlook conference in Arlington, Virginia. “There is nothing here that changed the overall narrative.”

The USDA gathering landed at a time of intense trade negotiations between Donald’s Trump administration and China. Talks on Friday showed signs of progress as the discussions were extended after officials made an agreement on currency policy.

In fact, the biggest news of the week from the USDA came as the conference was drawing to a close when Agriculture Secretary Sonny Perdue announced on twitter than China had committed to buying more U.S. soybeans.

American farmers have been caught in the crossfire of the Beijing-Washington trade war after the Asian nation slapped retaliatory duties on American agricultural goods.

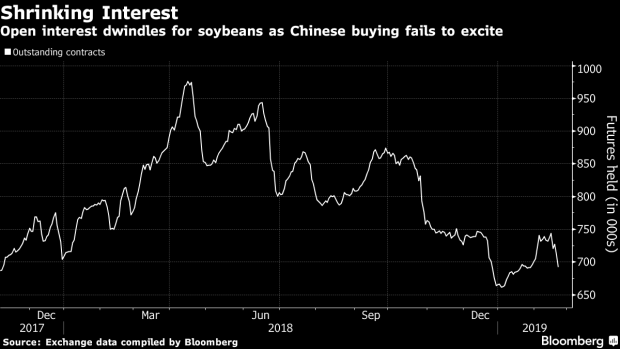

China has recently been back in the market for U.S. soybeans. The purchases have been part of a goodwill effort amid the trade negotiations. Traders would like to see the Asian country come back with “market-driven” purchases rather than just political ones, Feltes said.

“Trade negotiations may not have been a dynamic factor in the past” as a backdrop at the USDA conference, Seth Meyer, chairman of the World Agricultural Outlook Board who oversees the forum, said in an interview on the sidelines of the conference. This year, “it’s on a lot of people’s minds.”

The trade spat caused huge ripples throughout the global agriculture industry. Normal export routes were disrupted as the Asian nation increasingly bought from anywhere but the U.S.

“It’s affecting global markets,” Ramiro Costa, deputy executive director of Argentina’s Bolsa de Cereales de Buenos Aires, said after giving a presentation on the country’s agriculture sector. “It’s reshaping the trade flows.”

While increased demand for South American crops boosted premiums for some farmers, it also sparked unintended consequences like higher food costs for livestock producers and less available crop for soybean plants.

“We are hoping for a friendly resolution to restore the trade flows,” Costa said. “The faster they resolve this the better for the markets.”

For U.S. farmers, trade is a huge factor because so much of their production goes overseas, William Northey, USDA’s under-secretary for farm production and conservation, said in an interview. Nearly half the soybeans grown annually and more than a fifth of the pork the U.S. produces has been exported in recent years.

Northey, who originates from Iowa, said farmers from his state are telling him they don’t just want restored exports of soybean and pork to China, but want to see the market opened up for other commodities such as corn and chicken that the U.S. doesn’t ship much of to the Asian country currently.

Producers are also telling him that they want China to be a “more consistent” buyer, Northey said.

Trade has a “huge impact” because “the world has been in a very productive mode” and the agriculture surpluses need to find a home, he said.

To contact the reporter on this story: Shruti Date Singh in Chicago at ssingh28@bloomberg.net

To contact the editors responsible for this story: Millie Munshi at mmunshi@bloomberg.net, Joe Richter

©2019 Bloomberg L.P.