Aug 8, 2019

Italian Bonds Fall After Salvini Threatens to Break Up Coalition

, Bloomberg News

(Bloomberg) -- Italian bonds declined after a report that Deputy Prime Minister Matteo Salvini is threatening to bring down the government unless his demands for changes in the cabinet are met.

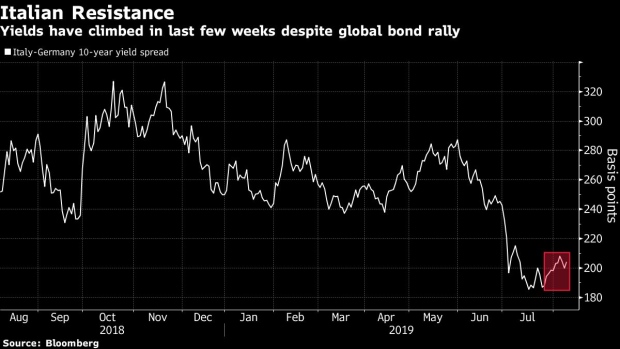

The 10-year yield premium over Germany, a key gauge of risk in the Mediterranean nation, climbed toward the widest level in a month. The newspaper Corriere della Sera reported that Salvini has given Prime Minister Giuseppe Conte until Monday to replace some cabinet members including Finance Minister Giovanni Tria, who is seen as a brake on the coalition’s spending plan.

“It was Salvini saying if he doesn’t get his own way, the coalition isn’t for him,” that drove Italian bonds down, said Lyn Graham-Taylor, senior rates strategist at Rabobank International. “We like tighter peripheral spreads.”

The sell-off underscores the fact that investor sentiment toward the populist government still remains fragile, even after a global hunt for positive yields fueled a rally in the nation’s bonds in recent months. While the 10-year debt of peers such as Portugal and Spain now yield close to nothing, Italy’s still offers a yield of 1.5%.

The yield spread over Germany rose by as much as nine basis points to 2.09%, before paring the increase to four basis points. The 10-year yield was up five basis points at 1.47%, after touching a high of 1.53%. The two-year rate rose two basis points to -0.006.

To contact the reporter on this story: John Ainger in London at jainger@bloomberg.net

To contact the editors responsible for this story: Ven Ram at vram1@bloomberg.net, Anil Varma

©2019 Bloomberg L.P.