Oct 9, 2022

Italy’s Bonds Come Under the Spotlight After UK Budget Fiasco

, Bloomberg News

(Bloomberg) --

Still rattled by the meltdown in the UK bond market, traders are now turning their sights to Italy, where the risk of fiscal profligacy by another newly elected government in Europe looms large.

Giorgia Meloni’s incoming right-wing coalition is due to send its draft budget to the European Commission by Oct. 15. Any sign that leaders of one of the region’s most indebted countries are looking to ramp up borrowing could trouble investors, prompting a selloff in the nation’s debt.

While concrete details on their fiscal program may be some time away, traders are on edge after the fallout in the UK last month. Prime Minister Liz Truss’s plan for a vast spending spree in her first few weeks in office triggered a historic bond selloff, and forced the Bank of England to start buying sovereign debt again in the middle of a tightening cycle.

“There is clear read across from the case of the UK to Europe,” said Orla Garvey, portfolio manager at Federated Hermes. Italy’s budget “will be even more closely scrutinized given what has unfolded in the UK,” she said.

Fresh volatility in Italy would also have big implications for the ECB, which is set to keep raising rates as it battles record inflation. Calls are already growing for the bank to delay an eventual wind down of its balance sheet. While that would be a boon for the nation’s bonds, it would also be a headwind for traders navigating diverging fiscal and monetary forces.

Moody’s Investors Service last week warned that Italy has relatively little room to maneuver if it wants to keep debt on a sustainable path. European Central Bank official Fabio Panetta, widely seen as a stable hand, has ruled out becoming the next finance minister, further muddying the outlook.

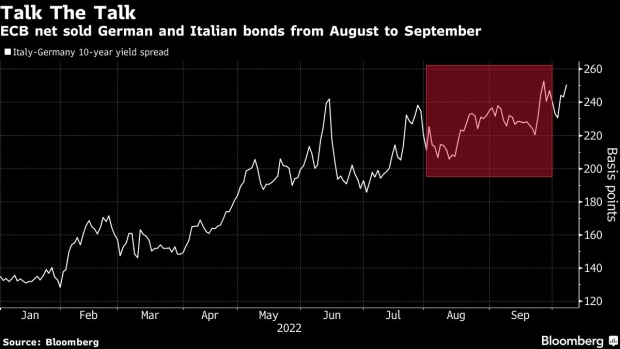

Uncertainty over how the Italian government will fund any new spending will put pressure on the nation’s bonds relative to Germany’s, Garvey said. The yield spread on 10-year securities was at 250 basis points on Friday, around the widest level this year.

UK Meltdown Helps Lagarde Make the Case for Targeted Fiscal Help

Despite the early signs of stress, the premium demanded to hold Italian bonds over safer German peers has crept rather than rocketed higher. A key factor in that relative calm is the support pledged by the ECB to stop “unwarranted” divergence in eurozone borrowing costs, or so-called fragmentation.

The recent market volatility in the UK “has brought financial stability to the fore again,” RBC Capital Markets strategist Peter Schaffrik wrote in a note. “We expect that the ECB will tread carefully.”

The ECB said in June its first line of defence would be to skew bond reinvestments toward more vulnerable nations. It also announced a new bond-buying tool the same month.

Yet data last week showed the ECB did not make use of that flexibility over recent months, suggesting a pledge of support alone was enough to keep yields in check. A similar pattern emerged in the UK, when the BOE bought just £4.6 billion ($5.1 billion) of the £40 billion of gilts it had earmarked for the operations so far.

“Years of QE has established their credibility as a large buyer,” said Rishi Mishra, an analyst at Futures First. “I think central banks are exploiting that credibility to backstop extreme volatility in rates, at a relatively minimal cost to their fight against inflation.”

ECB Reined In Bond-Market Support for Southern Europe in Summer

Still, the new government has inherited a weak economy dependent on energy imports and in desperate need of European Union funds. The ECB has also indicated repeatedly that its support cannot be expected if volatility is driven by domestic issues, calling into question its determination to act swiftly in the event of a rout.

“We are waiting for the budget, and how the new government will behave in relation to the NGEU and if they will keep to the rules,” said Ute Rosen, a senior derivatives specialist at Union Investment. “These are the big question marks.”

This Week

- A large line up of scheduled ECB and BOE policymaker speeches will offer investors further opportunity to gauge appetite for further tightening

- Appearances by President Christine Lagarde and Governor Andrew Bailey will garner most of the attention after money markets raised ECB peak rate expectations 14bps last week and wager on 115 basis points of BOE hikes next month

- Bond sales from Germany, Italy, Netherlands and Portugal are forecast to total about 22 billion euros ($21.5 billion), according to Citigroup Inc. Danske Bank A/S expects the EU to sell a new 30-year security via banks for up to 8 billion euros. The UK sells 4.4 billion pounds of gilts and inflation-linked notes

- The few euro area and German economic figures due out this week are mostly second-tier and backward-looking. The UK releases August GDP numbers as well as employment, earnings and trade figures

©2022 Bloomberg L.P.