Nov 13, 2019

Jack Ma Is Ripping Up a $12 Trillion Stock Market

, Bloomberg News

(Bloomberg Opinion) -- Jack Ma is riding high this week. Alibaba Group Holding Ltd., the company he founded, has won approval to forge ahead with a Hong Kong share sale that could raise at least $10 billion. On Monday, China’s largest e-commerce company logged more than $38.3 billion of purchases during its annual Singles’ Day shopping event, a new record.

The rest of China’s retail sector hasn't been so lucky. Just as shoppers were placing gadgets in their carts, investors were selling their consumer stocks. In two days, Gree Electric Appliances Inc. of Zhuhai and peer Midea Group Co. tumbled 7.4% and 6.2%. That’s despite electronics companies notching a 30% rise in sales this Singles’ Day.

What explains the selloff?

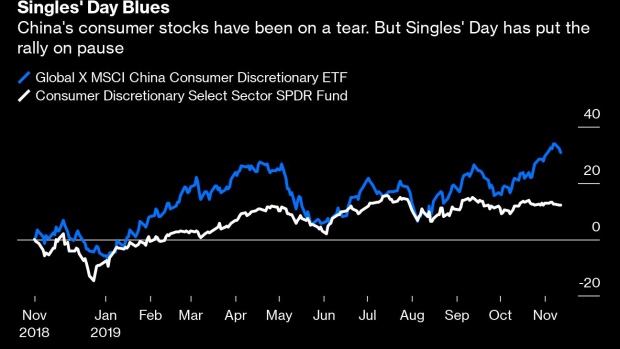

Blame Jack the Ripper. He’s killing the most beloved trade in China’s $12 trillion stock market: a bet on consumers. The retail sector, excluding cars, has been remarkably resilient this year.

Now Alibaba’s Singles’ Day has kicked off a price war. Over the weekend, Gree announced it would forgo 3 billion yuan ($427.5 million) in profit just to please China’s lonesome hearts. Its air conditioners sold for as little as 1,399 yuan, a 42% discount, both online and at the company’s thousands of retail outlets. China’s biggest electronics makers have been caught in a three-way race, so it’s little surprise that rivals from Midea to Haier Electronics Group Co. quickly followed suit.

Investors were already looking at Monday’s stellar statistics with suspicion, after an alarming report over the weekend that producer prices fell again in October. Call it bad timing — blockbuster sales on the heels of dour economic data. It’s also a stern reminder that deflation still grips broad swathes of the economy.

There are good reasons to like consumer stocks. They are a bet on China’s rising middle class. Companies like Gree and Midea are also highly profitable, both notching a return on equity of more than 25%. This may not last much longer, however, with falling prices spreading through China’s manufacturing sector. A full-blown price war that erodes these companies’ profitability seems inevitable.

In that light, you could argue that Alibaba is a good hedge against China Inc.’s deflation problem. If consumers expect deals, they’ll only visit the company’s Taobao and T-Mall platforms more frequently.

When Alibaba lists in Hong Kong later this month, mainland investors will get an opportunity to buy shares via the stock connect with Shanghai and Shenzhen. Some may well dump their consumer-stock holdings to free up money for the e-commerce company. Everyone likes a good bargain; but once price wars take hold, it can be tough to find the basement.

To contact the author of this story: Shuli Ren at sren38@bloomberg.net

To contact the editor responsible for this story: Rachel Rosenthal at rrosenthal21@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Shuli Ren is a Bloomberg Opinion columnist covering Asian markets. She previously wrote on markets for Barron's, following a career as an investment banker, and is a CFA charterholder.

©2019 Bloomberg L.P.