Jan 27, 2023

Janet Yellen Sees Recession Risk Even With Improving Inflation, Jobs

, Bloomberg News

(Bloomberg) -- Treasury Secretary Janet Yellen said she’s encouraged by recent US data on inflation and jobs but conceded the economy is at risk of recession amid high interest rates.

“I’m reasonably satisfied by the data that I’ve seen so far, but I don’t want to minimize the risk of recession,” given the Federal Reserve is “slowing down the economy,” Yellen said Friday in an interview with Bloomberg News in Johannesburg as she wrapped up a trip to Africa.

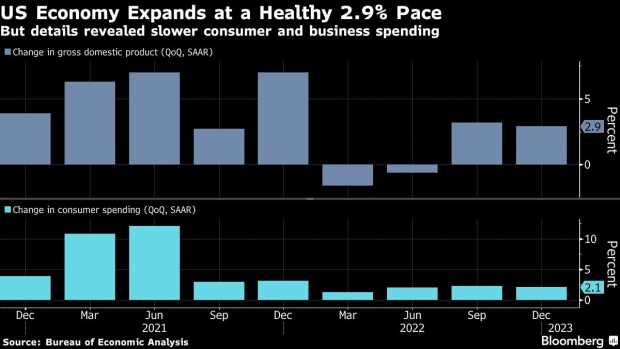

A government report released Thursday showed the US economy expanded at a better-than-expected annualized pace of 2.9% in the fourth quarter of 2022, yet the underlying data suggested growth was beginning to slow.

Personal consumption, the US economy’s most important driver, rose at a 2.1% yearly pace, less than economists had expected, while inflation-adjusted final sales to domestic purchasers — a gauge that strips out trade and inventories — increased just 0.8%.

That may not be surprising against a backdrop of aggressive Fed interest-rate increases aimed at smothering high inflation. But accomplishing that task without stalling the economy and pushing unemployment meaningfully higher is historically difficult.

“I’m not seeing any real unwinding, unraveling of economic activity,” Yellen said.

The latest Bloomberg monthly survey shows economists expect the economy to shrink in the second and third quarters, putting 65% odds on a recession in the coming year.

“I’m encouraged because I see inflation coming down,” said the Treasury chief, who also chaired the Fed for four years. “There’s more talk about layoffs, but fundamentally, the labor market remains quite tight.”

Other Biden economic officials have stopped short of flagging recession risks, and Yellen has been out of sync before. In particular, she had irked Biden advisers by admitting publicly that her projections for inflation back in 2021 — specifically that it would not remain high for long — were wrong.

Previously, Yellen told CBS News in an interview aired last month that “there’s a risk of a recession. But it certainly isn’t, in my view, something that is necessary to bring inflation down.”

Should the economy avoid unexpected shocks, Yellen said Friday it comes down to the labor market over whether the Fed can achieve its so-called soft landing. But even that won’t mean avoiding any uptick in unemployment.

The jobless rate in December was 3.5%, matching the lowest level in about 50 years. Yellen said in recovering from the Covid pandemic and the fallout from Russia’s invasion of Ukraine, the labor market had probably overshot the long-run sustainable level of unemployment.

“The path that I see, to maintaining a strong labor market while bringing inflation down, does involve a slowdown in growth,” she said.

©2023 Bloomberg L.P.