Jul 20, 2022

Japan Gold is poised to capitalize on an essentially untapped, gold-rich country

- For 75 years, foreign mining companies could not operate independently in Japan, leaving a large network of closed mines in the northern and southern parts of the country

- Japan Gold is the first foreign mineral exploration company to focus solely on Japan

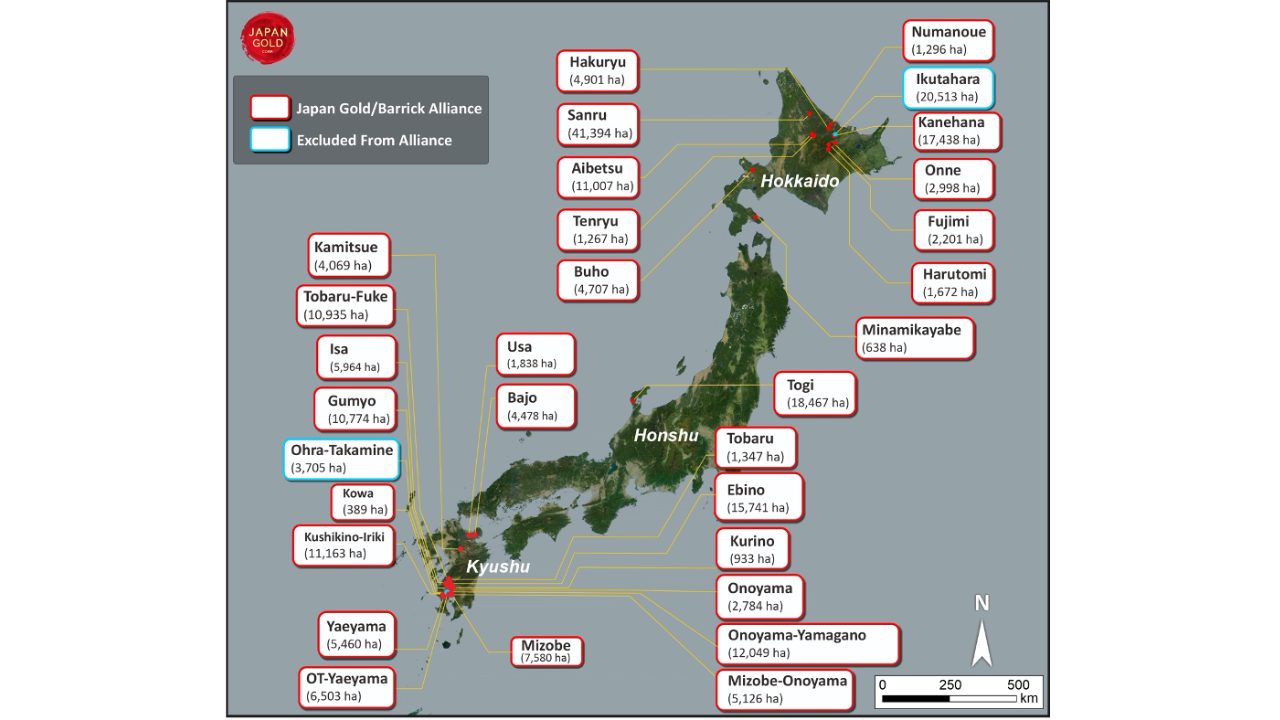

- The company has secured 31 projects on the 3 main islands of Japan, Hokkaido, Kyushu and Honshu

Japan has a rich history of high-grade gold mining from many mines but in 1943, the government declared a moratorium on gold mining to focus the mine workers on its war efforts. With foreign companies unable to operate independently in Japan, a large network of mines, predominately in the northern and southern parts of the country, have remained closed and unexplored for almost 80 years.

It took another historical upheaval to amend the Japanese Mining Act in 2012. This time a global economic crisis coupled with a devastating earthquake and tsunami spurred an urgent need for an economic stimulus. The amendment allowed, for the first time in Japan history, the ability for foreign companies to operate independently in Japan and lead the re-opening of the gold mining industry.

In a country where mining activities have been suspended for decades, Japan Gold Corp. (TSXV: JG | OTCQB: JGLDF) has carved out an enviable position. In fact, it holds the distinction of being the first foreign exploration company to focus entirely on gold opportunities in Japan.

“As word got out that Japan Gold was the first mover, with a significant portfolio of projects across the major gold districts of Japan, the global mining community woke up and took notice.” - John Proust, CEO, Japan Gold Corp.

With such a long moratorium, Japan remains a gold rich country, says Japan Gold’s chairman and CEO, John Proust. “Japan’s single operating gold mine, the Hishikari Mine owned by Sumitomo Metal Mining Co. Ltd., is one of the highest grade, Tier 1 gold mines in the world today. Between 1985 and 2020 it produced more than 8 million ounces of gold at average gold grades of 30 to 40 grams per tonne and continues to do so today.”

Beyond the favourable geological landscape, Japan offers many additional advantages for exploration companies, including a stable, corruption-free jurisdiction, a well-established and transparent mining regulatory framework, and a government committed to promoting economic development and foreign direct investment.

Achieving first mover advantage in Japan's most prospective project areas

When Japan opened licensing to foreign mining companies in 2012, Proust and his team moved quickly to gain a foothold ahead of global competitors. “Being the first mover allowed us to study mines that were closed in World War II and have never re-opened,” he says.

The year before, Proust had formed an investment bank with very strict criteria: seek opportunities for high-grade gold deposits, in safe political jurisdictions where foreign investment is accepted and where the company’s technical teams can identify the assets they are targeting. He explains, “We ended up finding 20 potential opportunities globally, Japan included. Given it had just changed the mining law, we immediately realized it could be a very fertile region to find or re-discover high quality gold deposits.”

In its early exploration phase, Japan Gold focused exclusively on low sulphidation epithermal gold deposits, which coincidentally is the same type of deposit being mined at the Hishikari Mine. “We applied for key areas of Japan that looked the most promising based on our review of all closed gold mines in Japan,” says Proust. “Being the first mover gave us access to the best available properties.”

Today, Japan Gold has secured 31 projects in 5 areas mainly in the islands of Hokkaido in the north and Kyushu in the south. In total, the sites encompass 47 of the country’s 64 closed gold mines in areas with known gold occurrences, a legacy of gold mining and strong prospects of high-grade epithermal gold mineralization.

Japan Gold has also established a fully operational team of geologists, field assistants, permitting and drilling specialists and administrative support, as well as wholly owned drilling rigs to enable rapid deployment.

“As word got out that Japan Gold was the first mover, with a significant portfolio of projects across the major gold districts of Japan, the global mining community woke up and took notice,” says Proust. When Japan Gold opened a competition for countrywide alliance partners in 2020, it attracted the interest of five global mining companies, including Barrick Gold and Newmont.

The country-wide alliance with Barrick Gold boasts promising results

In February 2020, Japan Gold formed a country-wide alliance with Barrick Gold Corporation to jointly explore, develop, and mine certain gold mineral properties and mining projects in Japan. As part of the agreement, Barrick agreed to solely fund a two-year initial evaluation phase of 29 projects. Barrick’s goal is to select projects that they feel have the potential to host Tier 1 or 2 ore bodies (i.e., 5 million or 3 million ounces of gold or greater) and will enter a subsequent Barrick-funded three-year second evaluation phase of those projects.

Since the Barrick Alliance was formed, the area of the portfolio has increased 42 per cent as geochemical sampling and geophysical surveys have identified over 40 significant gold anomalies of high interest. They have also defined a series of areas of interest from the regional programs and are ranking anomalies to guide ongoing work programs

With such promising results, Barrick requested an extension of the two-year initial evaluation phase by six months to August 31, 2022. This will allow Barrick to receive all the data collected across the portfolio, complete site visits and determine which projects will move forward. Barrick is now nearing completion of its review of the 29 projects with announcements expected shortly and Proust is optimistic.

Joining forces with Newmont to advance a high-potential gold frontier

The two remaining projects and the most advanced in Japan Gold’s portfolio – the Ikutahara Project in Hokkaido and the Ohra-Takamine Project in Kyushu – have the support of Newmont. “Newmont has provided significant technical support on these projects as a large equity shareholder of Japan Gold and has the right of first refusal to be our joint venture partner on these projects, should we want a joint venture partner,” explains Proust. “Japan Gold solely funds the activities on these two projects.”

This year, 3 separate drill programs are planned for completion at the Ikutahara Project. At the Ryuo prospect, 11 diamond drill holes were drilled in 2021 with very significant high-grade results. Intersected gold-mineralized vein structures include 20m @ 6.3 g/t gold and 0.45m @ 1,395 g/t gold. Drilling has continued to encounter high-grade vein intersections along an 800-metre strike zone. These preliminary results indicate that increasing the depth of the mine results in broader veins and higher gold grades. 7 more drill holes were completed in June 2022, and the results are expected late in Q3.

"The Ryuo results have been extremely encouraging and have advanced our understanding of the geology and the development of a mineralization model for the prospect,” says Andrew Rowe, vice president of exploration at Japan Gold. “What we learn at Ryuo will help focus ongoing exploration efforts on the numerous other prospects within our regional portfolio,” he says. In addition, there are 20 historic mines dotted across the Ikutahara Project that were closed in 1943 and never reopened. Part of Japan Gold’s work is determining whether some of these mines may represent one large system. There is compelling evidence that this may be the case.

Take your portfolio to the next level with a company poised for growth

After 10 years of preparation and early exploration, Proust says their initial instincts about the potential of high-grade gold deposits are proving to be well-founded. “Japan is covered with mines and districts that have not come close to their full potential. In many cases, we use the most current methods of mineral exploration to target ore bodies that are not evident at the surface.”

“Japan Gold is well-funded to complete our 2022 drilling and technical programs, notwithstanding market vagaries,” Proust adds. “Not only do our investors support our exploration activities, but they are providing capital with the expectation that we are able to construct one or more mines in the future.”

The Board of Directors and Executive team is a veritable who’s who of international industry leaders. From Ian Burney, former Canadian ambassador to Japan, Mitsuhiko Yamada, former executive officer and general manager of resources at Sumitomo Corporation, Takashi Kuriyama, former Sumitomo Metal Mining Co. Ltd. head of global exploration, Michael Carrick, a top global mining executive, and Paul Harbidge, former head of exploration at Randgold Resources Ltd. in Africa.

Japan Gold stands out as a truly unique junior mining company in more ways than one. “We had a four-and-a-half year first mover advantage, before the next party to come in, that allowed us to analyze all the historical mining activity and select the 31 projects we feel hold the most promise,” says Proust.

“We are the only gold mining exploration company to have Barrick and Newmont embedded in our business and we are being fully funded by Barrick on the evaluation of 29 projects,” he says. “Japan Gold has significant funding from a group of large international investors to achieve our objectives. New investors can join our shareholder register to participate in the benefits of our 10 years of exceptionally hard work and accomplishments.”

For more information on Japan Gold Corp., visit its website here.

Make sure to follow Japan Gold on social media for the latest updates: