Jul 18, 2019

Japan Inflation Hits 2-Year Low as BOJ Faces Pressure to Act

, Bloomberg News

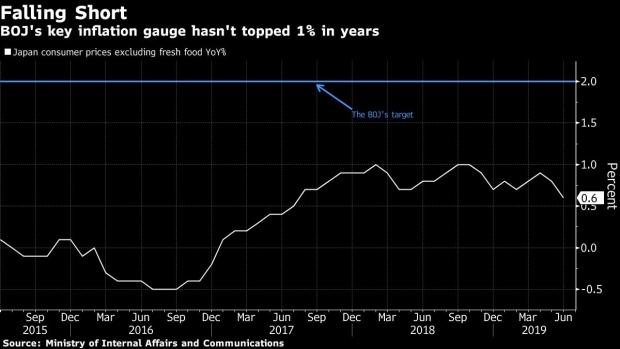

(Bloomberg) -- Japan’s key inflation gauge fell again in June, adding to pressure on the Bank of Japan to join its global peers in increasing monetary stimulus.

Consumer prices excluding fresh food rose by 0.6% in June from a year earlier, which matched economists’ median estimate, data from the internal affairs ministry showed Friday. That was the lowest reading since July 2017.

Key Insights

- Slowing inflation adds pressure on the Bank of Japan to step up its stimulus, especially with the Federal Reserve widely expected to start cutting rates later this month. The problem is the BOJ’s arsenal is largely depleted.

- Lower mobile phone service charges and free preschool education are among factors expected to drag inflation lower in coming months. The Fed’s dovish turn has also helped strengthen the yen, weakening inflationary pressures via lower import costs.

- A sales tax increase slated for October is also a worry for policy makers. Previous increases have hit consumers hard, sending the economy reeling.

What Bloomberg’s Economists Say

"We expect core inflation (excluding fresh food) to slow toward autumn. Policy-related factors -- lower mobile phone service charges and reduced education costs -- are the major drivers."--The Asia Economist TeamClick here to read more

Get More

- Overall, Japan’s consumer prices rose 0.7% in June, matching economists’ median estimate.

- Stripping out energy and fresh food, consumer prices climbed 0.5%. The median estimate was a 0.5% gain.

To contact the reporter on this story: Yoshiaki Nohara in Tokyo at ynohara1@bloomberg.net

To contact the editors responsible for this story: Malcolm Scott at mscott23@bloomberg.net, Henry Hoenig, Paul Jackson

©2019 Bloomberg L.P.