Aug 22, 2019

Japan Inflation Hovers at Two-Year Low as BOJ Easing Talk Grows

, Bloomberg News

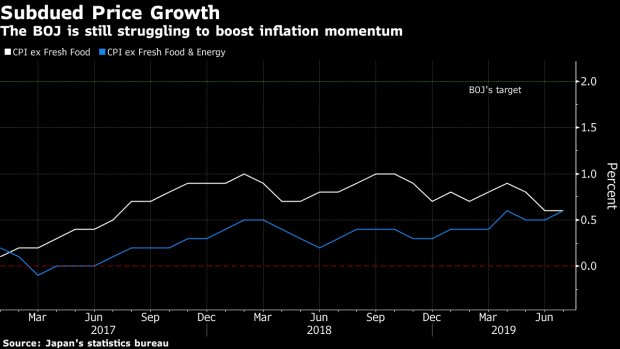

(Bloomberg) -- Japan’s key inflation gauge remained unchanged in July amid increasing speculation that the Bank of Japan may ramp up its stimulus as early as next month.

Consumer prices excluding fresh food rose 0.6% in July from a year earlier, matching economists’ median estimate, according to data from the internal affairs ministry Friday.

Key Insights

- A stubbornly low inflation rate makes it harder for the BOJ to argue it’s slowly but steadily making progress toward its 2% inflation target.

- Price growth is expected to slow further in coming months as a result of lower oil prices and government measures to make pre-school education free.

- Smaller upward gains in energy prices were a key factor keeping inflation subdued in July.

- Some BOJ watchers see a growing chance of Japan’s central bank ramping up its stimulus measures as early as September given a gloomier economic outlook that is likely to prompt Federal Reserve and European Central Bank action, moves that could strengthen the yen.

- Still, Prime Minister Shinzo Abe’s government appears relatively comfortable with recent tepid price growth, given its concerns that a sales tax increase in October will squeeze household budgets over the following months.

What Bloomberg’s Economists Say

“Looking ahead, we expect core inflation (excluding fresh food) to slow toward autumn. Policy-related factors -- lower mobile phone service charges and reduced education costs -- are the major drivers.”

--Asia Economist TeamClick here to read more

Get More

- Overall, Japan’s consumer prices rose 0.5% in July, weaker than economists’ median forecast of 0.6%.

- Stripping out energy and fresh food, consumer prices climbed 0.6%, better than a 0.5% estimate.

--With assistance from Tomoko Sato.

To contact the reporter on this story: Toru Fujioka in Tokyo at tfujioka1@bloomberg.net

To contact the editors responsible for this story: Malcolm Scott at mscott23@bloomberg.net, Henry Hoenig, Paul Jackson

©2019 Bloomberg L.P.