May 18, 2023

Japan Inflation Quickens Again, Putting Pressure on BOJ View

, Bloomberg News

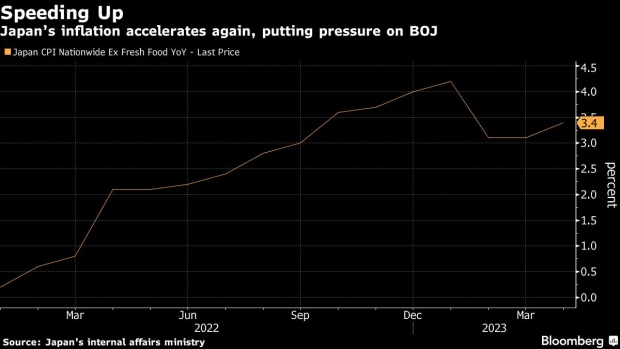

(Bloomberg) -- Japan’s inflation re-accelerated in April after cooling earlier in the year, likely supporting views that the central bank may have to revise its price outlook, bringing the Bank of Japan a step closer to policy normalization.

Consumer prices excluding fresh food rose 3.4% from a year ago, quickening from the previous month driven by gains in processed food and hotel prices, the internal affairs ministry reported Friday. The result came in line with analyst forecasts.

The national data was consistent with the results of the leading Tokyo figures, which showed renewed upward momentum after two months of deceleration.

The acceleration in the key inflation gauge will likely cement the view of many BOJ watchers that the central bank will bump up its price forecasts, leading to speculation over policy adjustment as early as July this year.

“These are very strong figures,” said Yoshiki Shinke, senior executive economist at Dai-Ichi Life Research Institute. Underlying inflation “continues to accelerate reflecting businesses passing their costs onto consumers. There is no doubt that the BOJ will raise its inflation outlook for this fiscal year in July.”

In the latest quarterly outlook report, the BOJ projected core prices rising at just 1.6% in fiscal 2025, implying that the bank’s 2% sustainable inflation goal won’t be achieved within its forecast period.

At the same time, new BOJ Governor Kazuo Ueda has indicated that once the inflation target comes into sight, he would adjust existing policy, including the yield curve control program.

Read more: Japan’s Sticky Prices Seen Pushing BOJ to Mull Higher Forecasts

Processed foods continued to drive overall inflation, boosting it by 2 percentage points. Food prices rose 9% compared to the previous year, the biggest jump since 1976. Service costs increased 1.7%, the biggest gain since 1995 excluding the impact of sales tax hikes.

Prices excluding the impact from energy and fresh food, a measure of the deeper inflation trend, also quickened to the fastest pace since 1981.

Food price hikes also don’t seem to be ending anytime soon. About 5,600 food items are expected to rise in price from June onward, according to a Teikoku Databank report. “Food price increases will continue at least until this fall,” the data firm said.

What Bloomberg Economics Says...

“We think the Bank of Japan will have to raise its inflation forecast further...Even so, an upward revision wouldn’t bump the central bank out of its holding pattern — its focus now is a policy review to build a basis for a shift down the road.”

— Taro Kimura

Click here to read the full report.

Some BOJ watchers believe the central bank may have played down the strength of inflation in its latest forecasts last month. The bank may be leaving scope for a sharp upgrade of its price view in July that can accompany a normalization step, some of them said.

Utility charges will continue to be a destabilizing factor in Japan’s price trends. Currently, gas and electricity prices are held down by government subsidies, masking the strength of underlying inflation. Without the government help, overall inflation would have been one percentage point higher, according to Friday’s data.

Prime Minister Fumio Kishida’s cabinet on Tuesday approved a request by major power companies to raise household electricity prices starting in June, a move that is likely to spur inflationary pressure. This could provide a reason for Kishida to extend existing relief measures that are scheduled to expire in September, especially if he has an election in mind.

“It’s not desirable if the burden on households is heavy and the government does nothing to address the situation before an election,” said Masato Koike, an economist at Sompo Institute Plus. “Given the political schedule, the government may extend utility subsidies to buy time.”

Despite higher prices putting pressure on consumers, their appetite appears to remain strong due to a delayed recovery from the pandemic. Japan’s gross domestic product expanded in the last quarter ending in March, driven by more spending from households and businesses. Economists see resilient consumption sustaining the country’s recovery for the foreseeable future.

Recovering inbound tourism is another factor that’s likely to support the economy, while also causing inflation.

“The number of foreign visitors to Japan has risen due to the easing of border controls,” said Koike. “Foreigners also tend to be more tolerant of price hikes than Japanese people, so it’s easier for hotel operators to raise prices.”

(Updates with more details from report, economist comments)

©2023 Bloomberg L.P.