May 29, 2023

Japan Jobless Rate Falls in Positive Sign for Wages, Prices

, Bloomberg News

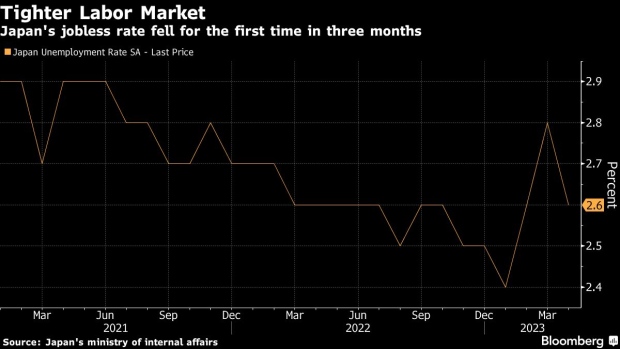

(Bloomberg) -- Japan’s unemployment rate fell for the first time in three months, potentially feeding into higher wages and providing support for the Bank of Japan’s sustainable inflation goal down the line.

The jobless rate dropped to 2.6% in April, as the number of those without jobs declined by 150,000 from the previous month, the ministry of internal affairs reported Tuesday. Economists had expected the unemployment rate to decline to 2.7%.

Separate data showed the jobs-to-applicants ratio remained unchanged from the previous month at 1.32, meaning there were 132 jobs available to every 100 applicants and indicating continued relative tightness in the labor market.

Tuesday’s employment figures reflect some positive developments in the Japanese economy, which appears to be showing further signs of recovery from the pandemic. The tightening jobs market could support recent wage growth and help sustainable inflation down the line, a scenario that both the government and the BOJ has been seeking.

“Various economic indicators show that the state of labor shortage is returning to pre-pandemic levels or worse, and there is strong pressure to raise wages,” said Koya Miyamae, senior economist at SMBC Nikko Securities.

In its most recent quarterly report, the central bank said that the results of wage talks to date suggest sizable gains in both small and large businesses as well as part-time workers, citing figures from Japan’s labor union Rengo.

Meanwhile BOJ Governor Kazuo Ueda has recently signaled his desire to maintain policy flexibility, and not rush to the conclusion that sustainable inflation has been achieved.

What Bloomberg Economics Says...

“Looking further ahead, the employment component of the Jibun Bank PMI survey suggests the overall labor market continued to tighten in May.”

— Taro Kimura, economist

For the full report, click here.

As virus-related restrictions have been further relaxed since March, Japanese firms across various industries have been grappling with an escalating shortage of labor. The BOJ’s latest Tankan report showed that firms are facing the worst manpower constraints in about four years.

The labor shortage is particularly pronounced in the service sector amid a recovery driven by inbound tourists and pent-up domestic demand. About 75% of Japanese hotel operators reported a shortage of full-time employees in late April, according to a Teikoku Databank survey.

To make up for the lack of workers, companies have been boosting investment in digitalization. Recent data suggested solid business spending had played a role in Japan’s economy expanding faster than expected in the first quarter.

--With assistance from Emi Urabe.

(Updates with more details from the report, economist comments)

©2023 Bloomberg L.P.