Jan 16, 2022

Japan Machine Orders at Highest in 2 Years Add to Rebound Signs

, Bloomberg News

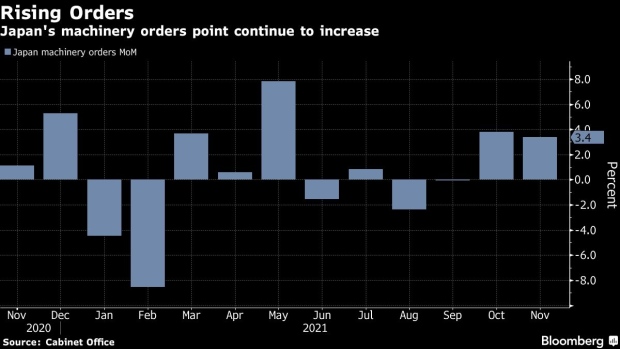

(Bloomberg) -- Japan’s machinery orders climbed to the highest in two years in November, adding to signs that the economy was rebounding in the final quarter of last year before the omicron variant emerged.

Core machine orders, a leading indicator of capital investment, rose 3.4% from the previous month to 900.3 billion yen ($7.9 billion), the highest level since November 2019, a month after a sales tax increase, according to figures from the Cabinet Office.

The monthly gain was almost three times the 1.2% gain forecast by analysts. Orders increased 11.6% from year-earlier levels.

The gain suggests capital investment was picking up after virus restrictions were lifted with infection cases falling and vaccination rates rising in November.

“We think business investment surpassed its pre-virus level this quarter and will continue to rebound over the coming quarters,” wrote Tom Learmouth at Capital Economics in a note. He sees non-residential investment rising 3% from the previous quarter in upcoming gross domestic product data for the last quarter.

“However, the level capital spending reached before the 2019 sales tax hike may not be regained until the end of next year,” he added.

Going forward, the new omicron variant and a rebound in infections pose a renewed threat to the economic recovery.

Daily nationwide virus cases have topped 25,000 again. While low by global standards, the level is close to Japan’s record for the pandemic and could trigger renewed restrictions in Tokyo if hospital beds continue to fill up.

What Bloomberg Economics Says...

“The rise was driven by pent-up demand and some easing of supply-chain constraints, particularly for manufacturers. That said, the outlook isn’t completely clear. The November orders came well before omicron risks started to flare.”

--Yuki Masujima, economist

To read the full report, click here.

©2022 Bloomberg L.P.