Sep 15, 2022

Japan’s Active ETF Push Faces Hurdles as Investors Flee

, Bloomberg News

(Bloomberg) -- Japan’s foray into listing actively managed exchange-traded funds next year may do little to boost liquidity for a market faced with foreign outflows, investors say.

The Tokyo Stock Exchange is planning to launch these ETFs in June as a way to stem thinning volumes and remain competitive against global peers, the bourse’s senior manager of equities Kei Okazaki said in an interview last week. The introduction comes after years of internal discussion on how to attract more foreign investors, he added.

The development is the latest effort by Japan’s exchange operator to enhance the market’s global status by introducing investor-friendly reforms. The measures so far, including a restructuring of market segments in April which was touted as the biggest revamp in 60 years by the bourse, have been met with muted response and seen as largely symbolic.

“It would be nice to have an assortment of options,” said Kenji Ueno, a portfolio manager at Sompo Asset Management Co. “However, there are many questions such as who is going to buy them, where is the need, and whether it can actually be a sellable product.”

Unlike traditional ETFs, actively managed products seek to beat instead of track market benchmarks. They boomed during the pandemic thanks to the rise of retail investors and their embrace of celebrity money managers like ARK Investment Management’s Cathie Wood. Actively managed ETFs are typically cheaper than equivalent mutual funds, though they tend to be pricier than the broader ETF universe.

The Financial Times first reported on the launch of active ETFs in Japan.

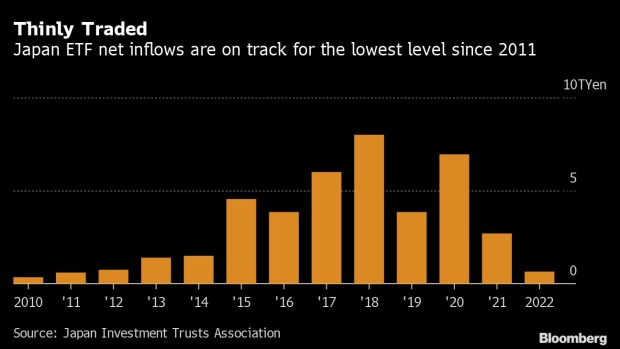

Japan’s stock exchange is already behind New York, Hong Kong and other major bourses in offering these products. A recent slide in the nation’s stock market driven by the yen’s depreciation and decades-high inflation is also hurting sentiment. Foreign investors have sold some $6.7 billion so far this year, according to Bloomberg data, on track for the fourth yearly outflow in five. Volumes traded on the Topix this year are also set to be one of the lowest levels in over a decade.

One key hurdle for investing in Japan’s 60 trillion yen ($419 billion) ETF market is the central bank’s dominance in the space. About a decade ago, the Bank of Japan’s bold monetary experiment resulted in it owning a whopping 80% of the country’s ETFs. Without those holdings, the market would be only worth about 10 trillion yen, according to Keiji Maegawa, senior manager for new listings at the exchange. He called the gap a “crisis” of investor confidence.

The frequency of disclosures by ETF issuers may also add to costs and weigh on its competitive edge. The Tokyo exchange said that it will require Japanese ETFs to disclose their positions on a daily basis, which caused criticism from market participants, Maegawa added. In the US, some disclosures are quarterly.

Recent poor performance of Cathie Wood’s ARK may make it harder for other money managers to launch actively management ETFs. ARK’s flagship fund is down more than 50% year-to-date, compared with a less than 20% decline for the S&P 500 index.

“Active ETFs need to be run by big-name investors with strong track records,” said CLSA Securities Japan Co.’s strategist Nicholas Smith, citing that poor performance of the likes of Cathie Wood’s ARK has hurt the appeal of such products. “Because of the global slide towards recession, this story is likely to be a slow-burn.”

©2022 Bloomberg L.P.