May 17, 2021

Japan’s Economic Recovery Stalls Amid Winter Virus Emergency

, Bloomberg News

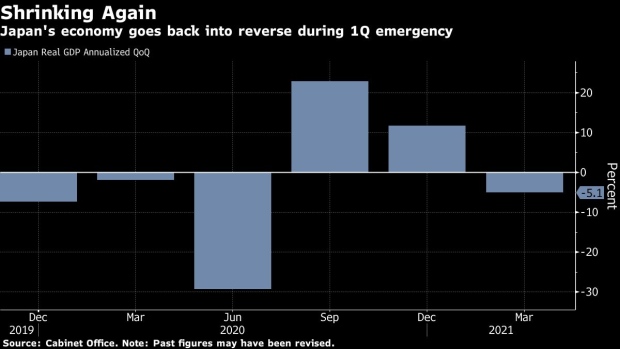

(Bloomberg) -- Japan’s recovery stalled last quarter, with the economy shrinking for the first time since last year’s pandemic collapse, as renewed restrictions to contain the coronavirus weighed on activity.

Gross domestic product shrank an annualized 5.1% from the prior quarter in the three months through March, ending a two-quarter streak of double-digit growth amid falling consumer spending and a drop in government outlays, the Cabinet Office reported Tuesday. Economists had forecast an overall contraction of 4.5%.

The worse-than-expected result comes at a critical time for Prime Minister Yoshihide Suga’s government as it struggles to contain virus cases with a targeted approach that limits the damage to the economy and a slow vaccine rollout.

Key Insights

- The outlook depends largely on whether Suga can lift a third virus emergency by the end of May, as planned. Three more prefectures joined the emergency at the weekend, bringing about half of the economy under restrictions that are slightly stricter than the ones called in winter, but still much less draconian than Europe’s lockdowns.

- Japan has had far fewer virus deaths than other G-7 economies, but a slow vaccine rollout has limited its tools for fighting the outbreak and getting the economy back into gear. So far, only about 3% of the population has received even a single dose.

Still, strong exports and industrial production continue to provide a bedrock of support to the economy, even though a rise in imports caused the trade-component of the GDP to go negative in the first quarter.

What Bloomberg’s Economist Says...

“Looking ahead to 2Q, we see GDP resuming a slow pace of growth, assuming the latest state of emergency ends at the end of May as planned. Beyond that, the strength of the recovery will depend on how quickly vaccinations proceed and whether the Tokyo Olympics are held.”

-- Yuki Masujima, economist

For the full report, click here.

Get More

- Private consumption, which accounts for more than half of the economy, fell 1.4% from the previous quarter on a non-annualized basis, compared with a 1.9% drop forecast by economists.

- Business investment also slid 1.4%. Analysts had predicted a 0.8% gain.

- Inventories added 0.3 percentage points to GDP, compared with a 0.2 percentage point boost expected by economists.

- Net exports of goods and services subtracted 0.2 percentage point from growth, matching the median forecast.

(Adds data on GDP components.)

©2021 Bloomberg L.P.