May 17, 2020

Japan’s Economy Sinks Into a Recession Set to Deepen Sharply

, Bloomberg News

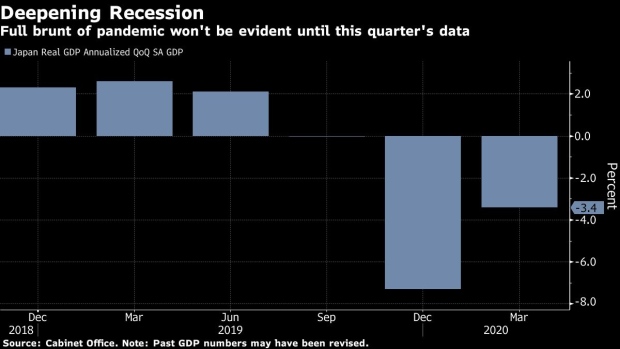

(Bloomberg) -- Japan’s economy sank last quarter into a recession that’s likely to deepen further as households limit spending to essentials and companies cut back on investment, production and hiring to stay afloat amid the coronavirus pandemic.

Gross domestic product shrank an annualized 3.4% in the three months through March from the previous quarter, the Cabinet Office reported Monday. The economy also contracted sharply in the final three months of last year, hit by a sales tax hike and a destructive typhoon.

Economists had forecast a 4.5% fall, as the start of social distancing last quarter crimped consumer spending, while supply-chain disruptions and sliding exports hurt manufacturers.

Key Insights

- Monday’s data confirm that the world’s third-largest economy fell into a recession even before Prime Minister Shinzo Abe’s April declaration of national emergency. Analysts see a 21.5% contraction this quarter, a record for official data going back to 1955.

- Barely two weeks after parliament passed a first extra budget, Abe last week called for a second that’s expected to provide rent support for small businesses and bigger subsidies for firms that don’t fire workers. Existing stimulus, including spending on cash handouts to households, already totals more than 20% of GDP.

- Business is just starting to reopen in Japan’s less-urban prefectures, where a drop in infection cases allowed the state of emergency to be lifted last week. But commerce is still largely frozen in economic centers like Tokyo and Osaka, which could remain under heavier restrictions through the month.

- Demand for Japanese exports is likely to stay depressed for a long time because, even though U.S. President Donald Trump and other leaders are debating how to reopen their economies, progress is likely to come in fits and starts.

- On the domestic side, spending isn’t likely to pickup quickly even after the state of emergency is lifted everywhere as people are likely to remain wary of venturing out and households may tighten their purse strings in response to lost income and a more precarious job market.

What Bloomberg’s Economist Says

“Beyond 1Q, high-frequency indicators suggest the pace of contraction deepened in 2Q, as the state of emergency declared in early April walloped activity. Spending might find some support, as households start to receive the 13 trillion yen in paychecks from the government this month.”

--Yuki Masujima, economist

Click here to read more.

Get more

- On a non-annualized basis, the economy shrank 0.9% from the fourth quarter. Economists projected a 1.1% contraction.

- Business investment fell 0.5%, compared with a forecast for a 1.5% drop.

- Private consumption slid 0.7%, versus a projected 1.6% fall.

- Net exports shaved 0.2 percentage point off non-annualized GDP.

(Adds detail on GDP components.)

©2020 Bloomberg L.P.