Nov 9, 2021

Japan’s Exodus From Australian Bonds Started Months Before Rout

, Bloomberg News

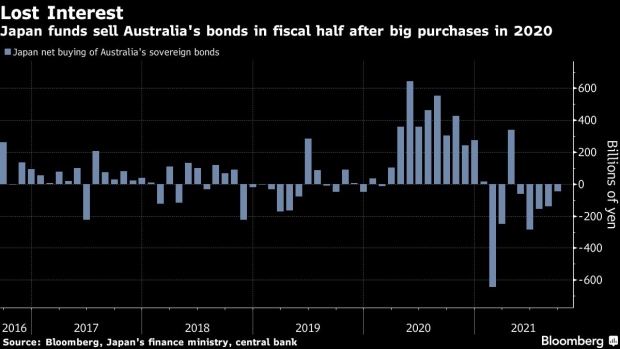

(Bloomberg) -- Japanese funds turned sellers of Australian bonds in the six months through September as yields tumbled and speculation grew that the central bank was moving toward tapering its debt purchases.

Funds in the Asian nation cut holdings of Aussie debt by 351.1 billion yen ($3.1 billion) over the period, the first net sales during a fiscal half-year since March 2019, according to Ministry of Finance data released Tuesday.

The sales by Japanese funds meant they avoided the steep losses seen in October when growing speculation the Reserve Bank of Australia would drop its yield-curve control program led to a selloff in the securities. Yields on 10-year Aussie bonds jumped 60 basis points that month. The RBA scrapped its yield-target policy on Nov. 2.

“Talk of monetary policy normalization raised the risk of rising yields and falling prices,” said Tsuyoshi Ueno, a senior economist at NLI Research Institute in Tokyo. Japanese investors had also shied away from Aussie bonds when their yields had dropped below similar-maturity Treasuries from July, he said.

Australia’s benchmark 10-year yield fell to 1.06% in late August from as high as 1.93% in February amid a global rally in bonds. The Federal Reserve made clear in August it intended to start scaling back bond purchases, spurring the Reserve Bank of Australia to say it would review its policy of using debt purchases to control the yield curve.

While Japanese funds sold Australian debt in the fiscal half-year, they purchased a net 5.2 trillion yen of Treasuries, and also boosted holdings of sovereign bonds in Canada, Italy and the Netherlands.

“The rise in U.S. yields after the Fed clarified its policy stance gave investors a sufficient income gain to offset the risk of further increase in yields,” NLI’s Ueno said. “U.S. yields rose but generally stayed in a range and that boosted their appeal.”

Read More: Japan Investors Buy Most U.S. Sovereign Bonds Since March 2020

©2021 Bloomberg L.P.