Aug 17, 2022

Japan’s Inflation Getting Harder for Kuroda to Explain Away

, Bloomberg News

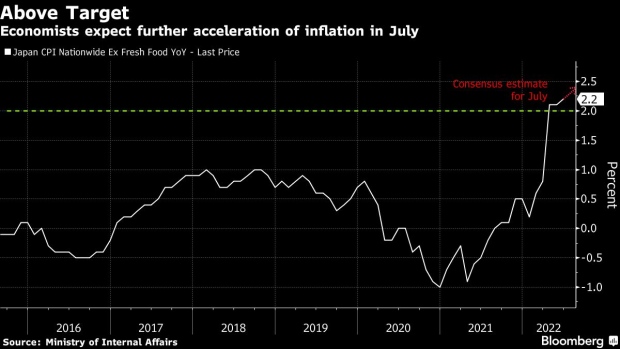

(Bloomberg) -- Japan’s inflation likely accelerated another notch beyond the central bank’s target level in July to further complicate Governor Haruhiko Kuroda’s message that rock-bottom rates must stay in place to support stable price growth.

Economists estimate that consumer prices excluding fresh food, the central bank’s key inflation gauge, hit 2.4% in July. That compares with 2.2% in the previous month, already the fastest pace since 2008 excluding tax-hike years.

The latest expected gain is unlikely to budge Kuroda from his insistence on stimulus for now. But a continued acceleration of price growth over the coming months will make his stance increasingly difficult to defend as his term as governor approaches its end next spring.

Most major central banks across the globe are racing to raise rates to rein in price growth, having given up on the idea that strengthening inflation is too transitory to warrant action.

Kuroda has continued to argue that existing inflation is largely due to temporary commodity price rises and isn’t accompanied by the kind of wage gains needed for a positive growth cycle.

“While the impact of energy prices will peak in July or August, moves to pass on raw material costs to consumers are clearly on the rise,” said Atsushi Takeda, chief economist at Itochu Research Institute. “The impact on BOJ policy isn’t going to be immediate, but what we’re seeing right now isn’t the sort of temporary energy boost to prices the BOJ seems to see.”

More and more economists are revising up their inflation forecasts for the end of the year, with Citigroup and SMBC Nikko expecting the key consumer price index to reach around 3% or more by the end of 2022.

A further fading of the impact of cheaper mobile phone fees in August and October is an additional factor likely to boost inflation.

Read More: Japan Economists Forecast Biggest Inflation Gains Since 1991

Citigroup says the higher inflation it sees still won’t be enough to trigger a faster policy shift from the BOJ.

Economists expect price growth excluding the impact of energy as well as fresh food to reach just 1.1% in July, giving some credence to the central bank’s argument that a large part of the gains are still energy driven.

The BOJ’s current inflation outlook:

Still, Itochu’s Takeda argues that it’ll gradually become clearer that a tight labor market is spurring wage hikes, leading to more widespread inflation. Japan’s latest unemployment rate was 2.6%, close to March 2020’s level of 2.5%.

He suggests the October policy meeting may provide an opportunity for the BOJ to signal a shift in its view when it next updates its price forecasts.

“We’re actually at the threshold of a period of normal inflation,” said Takeda. “If the price outlook, especially for core-core inflation, is higher in the October report, it’ll be a sign that the BOJ’s thinking may be changing.”

©2022 Bloomberg L.P.