Jan 20, 2021

Japan’s Power Crunch Has Investors Rushing for a Top Utility

, Bloomberg News

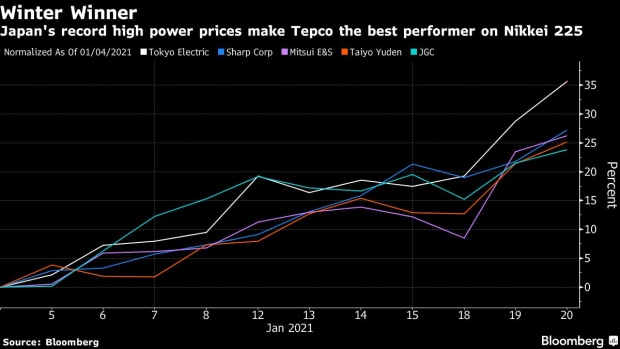

(Bloomberg) -- An energy crisis plaguing Japan has propelled its top power producer to become one of the nation’s best-performing stocks of 2021.

Tokyo Electric Power Co. Holdings Inc. has rallied 38% so far this year, outperforming every other company on the Nikkei 225 Stock Average. Wholesale power prices have spiked to an eye-watering record high on the back of colder winter weather and dwindling fuel supplies.

“Investors are jumping on with the news of an energy supply crunch,” said Shoichi Arisawa, an analyst at Iwai Cosmo Securities Co.

A cold blast sweeping North Asia has upended energy markets, sending prices for electricity, fuel and vessels surging. Japan’s power producers are bound to benefit from the spike in wholesale power rates, which have outstripped the price rally in imported fuels, like liquefied natural gas and oil products.

Electric Power Development Co., Japan’s top power wholesaler, has also gained 20% so far this year. Meanwhile, companies most dependent on the spot market to secure supply, like retailers without any power generating capacity, are likely the worst hit by the jump in wholesale prices.

Tepco shares have also been supported by local reports that its nuclear power plant in Niigata prefecture may be closer to receiving local approval to resume operations. A panel evaluating the restart of nuclear reactors at Tepco’s Kashiwazaki-Kariwa plant in Niigata will replace two members who had voiced concern about the move, Mainichi reported.

©2021 Bloomberg L.P.