Oct 26, 2020

Japan’s Top Airline Faces Challenges in Sustainable Fuel Drive

, Bloomberg News

(Bloomberg) -- Japan’s largest airline has signed up for jet fuel made from renewable materials in Singapore in a small step toward more environmentally friendly travel that will add costs for an industry crushed by the coronavirus.

All Nippon Airways signed a preliminary agreement to start buying so-called sustainable aviation fuel from a Singapore refinery run by Finland’s Neste Oyj. The deal will be expanded from 2023 when Neste will have capacity to produce 1.5 million tons of SAF a year, ANA said in a statement. The Singapore plant is being enlarged to meet increased demand for diesel and jet fuel produced from waste vegetable and animal fats and oils.

Airlines can’t ignore the inevitable shift toward biofuels triggered by campaigns to tackle the effects of aviation on the environment, Hiroaki Sugimori, who manages ANA’s sustainability department, said in an interview. The “Greta effect” -- a reference to climate change campaigner Greta Thunberg -- means airlines must adapt even if it involves higher fuel costs.

“We can’t ignore this when we think about the reputational risk,” Sugimori said.

Japanese Prime Minister Yoshihide Suga set an ambitious target for his country to become carbon neutral by 2050 in his first policy speech to parliament since taking office as premier last month. However, the timing for a shift to higher-cost, sustainable fuel could hardly be worse for airlines struggling to cope with the pandemic. According to Kyodo, ANA is predicting a record full-year net loss of 530 billion yen ($5 billion).

Scarce Supply

Beyond the industry’s struggle to survive, any shift to sustainable aviation fuel will be hampered by scarce supply.

“There are a limited number of producers for SAF compared to the demand,” said Kohei Yoshikawa, manager of ANA’s fuel procurement department. “As we looked into it, we began to realize that it’s not easy to get.”

In a test, ANA received on Saturday its first cargo of 7 million liters shipped from one of Neste’s European refineries to Haneda airport near Tokyo.

Global SAF production this year of some 40 million liters accounts for only 0.015% of jet fuel market, according to the International Air Transport Association. Yet, the group views SAFs as a key solution to curb the industry’s emissions growth. These non-fossil derived fuels must meet sustainability criteria, including reduced carbon emissions, limits on fresh water consumption, no deforestation and no competition with food production, according to IATA.

Asia has lagged behind other regions in terms of policy support as well as political pressure favoring SAFs, said Robert Boyd, assistant director of aviation environment at IATA. Asian interest in SAFs has been only sporadic, he said.

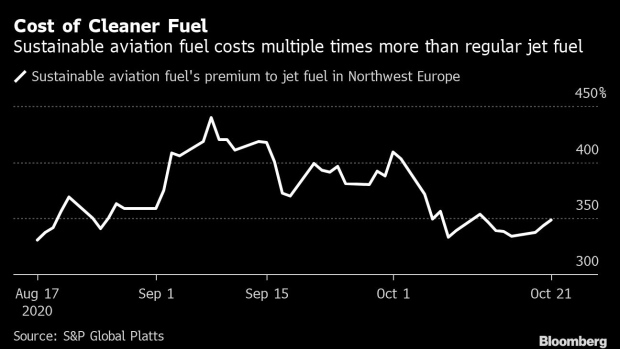

SAF has traded for several times the price of regular jet fuel in regions outside Asia in recent months. In Northwest Europe, the premium averaged 4.7 times the price of traditional jet fuel from mid-August, when S&P Global Platts started pricing SAF, to mid-October. On the U.S. West Coast, the premium was 3.5 times from mid-September to mid-October. Platts has yet to launch SAF prices in Asia.

Given the premium, ANA’s senior director of fuel procurement, Noriaki Muranushi, doesn’t expect SAF to “spread in popularity” without government support in the form of subsidies or incentives for domestic producers of sustainable aviation fuel as well as airline consumers.

“SAFs are challenged to compete on price with conventional jet fuel, absent incentives, and these challenges will remain going forward,” said Roman Kramarchuk, head of energy scenario, policy and technology analytics at S&P Global Platts.

While European policy makers are currently contemplating their own mechanisms, proactive airline action to reduce carbon emissions can help ensure SAF demand, even at higher prices, Kramarchuk said.

©2020 Bloomberg L.P.