Apr 9, 2020

Japan Short-Term Fund Rates Jump as Virus Hurts Corporate Mood

, Bloomberg News

(Bloomberg) -- Credit market rates are showing that the global rush for cash is intensifying in Japan as well.

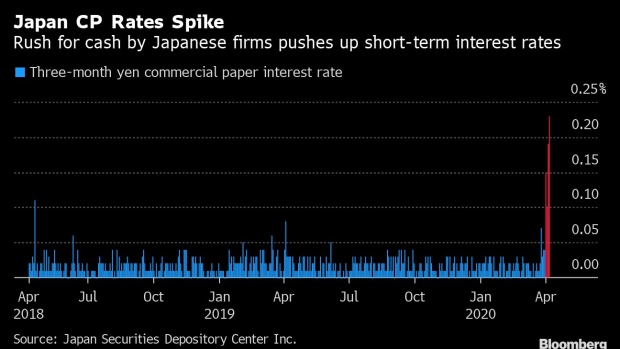

In a sign that Japanese companies are stockpiling cash due to deep worries about the impact of the coronavirus pandemic, short-term funding costs are surging. The rate to borrow with three-month commercial paper has jumped to 0.23%, the highest in at least two years, according to Japan Securities Depository Center Inc. data.

Companies worldwide are loading up on cash in anticipation of the virus outbreak causing a global recession, and monetary authorities including the Bank of Japan have bolstered measures to offer liquidity. Confidence among big Japanese manufacturers dropped to the lowest level since 2013 in March, with shipbuilders, automakers and metal producers especially gloomy, according to the BOJ’s Tankan survey.

“More and more companies are in need of short-term funds either because they are cash-strapped or want to have money for unexpected funding needs,” said Mana Nakazora, chief credit analyst at BNP Paribas SA in Tokyo. The commercial paper rates could come down once markets stabilize, she said.

The outstanding amount of commercial paper in Japan hit a monthly record of 22.8 trillion yen ($209 billion) in February, and eased back down to 20.9 trillion yen at the end of last month after the BOJ stepped up purchases of such debt.

©2020 Bloomberg L.P.