Jun 1, 2023

Japan Stocks Trading Value Hits Record on Foreign Buying, MSCI

, Bloomberg News

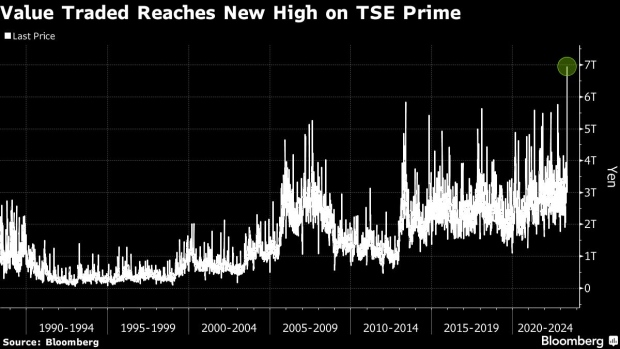

(Bloomberg) -- The frenzy for Japanese stocks hit a record high on Wednesday amid an ongoing surge in foreign demand for the nation’s equities and position adjustments taken before the rebalancing of an MSCI equity index.

The value of shares traded on the Tokyo Stock Exchange’s Prime Market Index reached an unprecedented level of almost 7 trillion yen ($50 billion) on May 31. Ministry of Finance data on Thursday showed foreign investors were net buyers of Japanese stocks for nine straight weeks in the period ended May 26, the longest run of purchases since November 2019.

Activity also got a boost on Wednesday as investors adjusted positions before MSCI added Kawasaki Kisen Kaisha Ltd. and deleted Nihon M&A Center Holdings as part of a quarterly review of its global standard indexes.

“No doubt the last minute trading was affected by passive fund re-balancing and speculators’ counter-trading in relation to the MSCI,” said Hayato Yoshida, a quants analyst at SMBC Nikko Securities.

©2023 Bloomberg L.P.