Jul 23, 2019

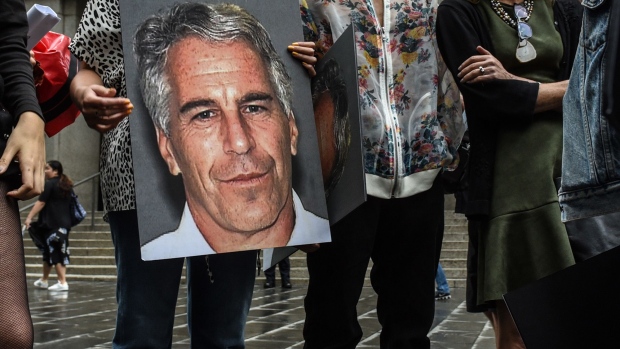

Jeffrey Epstein Confronts Legal One-Two Punch in Bid to Get Out of Jail

, Bloomberg News

(Bloomberg) -- Freeing Jeffrey Epstein on bail might be a strategic shot in the arm for the accused child sex trafficker’s defense -- but it’s a long shot for his legal team.

The advantage: freedom to help marshal a complicated case against charges that could put the 66-year-old money manager in prison for the rest of his life if he’s convicted.

But “the facts are against them, the law is against them and the appellate standard is against them. They are running uphill against a strong hurricane gale,” said Michael S. Weinstein, a defense attorney and former federal prosecutor who isn’t involved in the case -- adding for good measure that it’s like climbing Mount Everest.

Epstein filed papers on Tuesday morning indicating he’s appealing U.S. District Judge Richard Berman’s ruling Thursday rejecting his bail request. His home-confinement proposal included paying for armed guards to monitor him at his Manhattan mansion and an ankle bracelet to track him.

Prosecutors persuaded Berman to keep him confined to the Metropolitan Correctional Center in lower Manhattan, where he has been living since he was arrested on July 6 after getting off his private plane from Paris. Berman said he doubted that any bail package could overcome the danger he judged Epstein poses to the community.

Epstein is accused of molesting teenage girls from 2002 to 2005. He has pleaded not guilty to charges of sex trafficking in minors and conspiracy and says he has fully complied with the law for more than 14 years. He pleaded guilty in 2008 to Florida state charges of soliciting prostitution.

One-Two Punch

His continued detention complicates his trial preparations. He is being held in a segregated high-security unit his attorneys say gives him limited access to them and to court documents, and gives prosecutors added leverage. Whether those complications will move the appeals court to free him is another matter.

His lawyers argue his release is critical to his ability to prepare his defense, which would be “materially impaired” by further detention. They say the case, based on events that occurred at least 14 years ago, will involve “voluminous discovery” -- the exchange of documents between the two sides -- requiring his constant involvement.

But his wealth alone, which Epstein estimated in a recent financial disclosure at $559 million, will make it hard to get the appeals court to find that Berman clearly erred, Weinstein said.

“That in and of itself is a tremendous high hurdle here, because of the apparent evidence of his wealth, his access to flight, his availability to offshore money, his friends and family overseas,” he said. “You couple that with the danger to the community that the court found, and that’s a one-two punch.”

Epstein’s lawyers didn’t immediately respond to an email seeking comment.

Inconvenient, Not Impossible

Drug lord Joaquin “El Chapo” Guzman got ready for trial from jail. And Robert Allen Stanford spent three years in detention before he was tried for operating a Ponzi scheme. Both were convicted, but each was able to marshal complex defenses from behind bars.

“It makes it less convenient. It doesn’t make it impossible,” Weinstein said. “There can be accommodations made in prison where he can confer with his counsel at any time of day, any time of the week.”

Epstein’s secretive 2007 non-prosecution agreement with federal prosecutors in Florida thrust the money manager into the spotlight when the Miami Herald published an investigative series on the deal late last year. The public outcry that followed led to the resignation of U.S. Secretary of Labor Alex Acosta, who was lead prosecutor on the case at the time and worked closely with Epstein’s lawyers to craft the pact.

The case is U.S. v. Epstein, 19-cr-490, U.S. District Court, Southern District of New York (Manhattan).

(Updates with analysis from Weinstein.)

To contact the reporter on this story: Chris Dolmetsch in Federal Court in Manhattan at cdolmetsch@bloomberg.net

To contact the editors responsible for this story: Heather Smith at hsmith26@bloomberg.net, Peter Jeffrey, David Glovin

©2019 Bloomberg L.P.