Jun 22, 2022

Johnson Woes Tie Government in Knots Over Pay, Pensions, Strikes

, Bloomberg News

(Bloomberg) -- Boris Johnson’s decision to dramatically increase the UK state pension, even as he urges pay restraint for workers, shows how his perilous political position is muddling the government’s response to surging inflation.

The inherent policy contradiction was laid bare when Johnson’s spokesman, Max Blain, effectively acknowledged the government wants a real-terms pay cut for public sector workers to avoid an “inflationary spiral.” Moments later, he declined to comment on whether Johnson’s plan to hand pensioners about £10 billion ($12.3 billion) extra to spend next year would be inflationary.

The British prime minister barely survived an attempt by members of his Conservative Party to oust him just two weeks ago, and Johnson has been trying to shore up support ever since. But his efforts are complicated by the competing demands in his party, which are tying his government in knots.

During the UK’s worst rail strikes in three decades, Johnson knows taking a hard line on pay rises plays well with the more Thatcherite wing of his party -- especially with public sector salaries up for review in the coming weeks. To bolster the argument, he has also urged private companies to show restraint in the face of inflation set to hit double digits within months.

That kind of call is a slippery slope for a Tory government, however. Blain was also asked if ministers are also urging landlords to show restraint on rent increases, as another way of curbing inflation. He responded that it’s not for the government to intervene in the private housing market.

Meanwhile the government confirmed it’s reinstating the so-called triple lock -- where state pensions rise by earnings growth, inflation, or 2.5%, whichever is highest -- this year, after a one-year hiatus. Like landlords, pensioners are seen as typically more likely to vote Tory in elections.

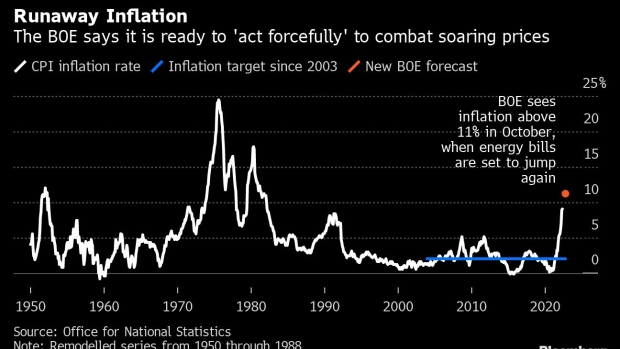

Inflation climbed to 9.1% in May, the highest in 40 years, and is forecast by the Bank of England to top 11% in October, when the energy price cap is reset.

‘Struggling Households’

Blain said the pensions increase would have less of an effect on prices than increasing public sector pay, because the latter may have the “spillover effect” of spurring higher wages in the private sector.

Yet the Institute of Economic Affairs, a free-market think tank, said the decision to increase pensions in line with inflation -- while not doing the same for workers -- is hard to justify.

“It may be difficult politically to renege on the triple lock again, but we should bear in mind that pensioners as a group are less likely to be in poverty than, say, families with young children,” the IEA’s Len Shackleton said in a statement. “Support for struggling households could be better targeted.”

Read More: UK Inflation Rises to New 40-Year High With More Gains Expected

That comment illustrates the major gamble at the heart of Johnson’s response. Sounding tough on strikes, labor unions and spiraling inflation appeals to some Tory factions; the reaction of the public may be a different story.

A snap poll by Savanta ComRes this week found a majority of voters see the rail strikes as justified, indicating they are sympathetic to the argument that pay should keep pace with inflation.

©2022 Bloomberg L.P.