Nov 18, 2019

JPMorgan Asset Lifts Global Stock View on Trade Talks, Eco Data

, Bloomberg News

(Bloomberg) -- JPMorgan Asset Management has upgraded its outlook on global equities, as the U.S. and China get closer to reaching a trade agreement and the probability of a U.S. recession recedes.

While still cautious on stocks overall, the money manager has “moved closer” to a neutral equity positioning in multi-asset portfolios, Patrik Schowitz, the firm’s global multi-asset strategist, said in a report.

Schowitz expects mid-single-digit stock returns in 2020. Emerging market and U.S. large-cap equities are now the firm’s most favored areas, and it is turning more positive on cyclical equity markets.

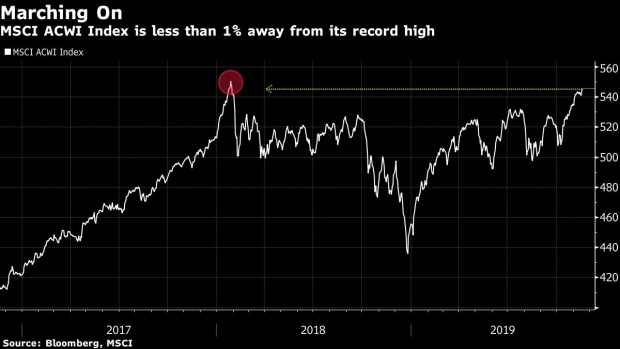

“The environment has shifted in recent weeks,” Schowitz said. “Investors appear to be regaining their appetite for risk,” with share prices rising from October lows. The MSCI All Country World Index is less than 1% away from an all-time high after the recent rebound.

In addition to optimism over a trade deal, Schowitz said the mood has lifted on improving macro data. The probability of a U.S. recession in the next 12 months has receded to 20-30% from nearly 50% “just a few weeks ago,” the firm estimates.

Earnings were better than expected in the quarter ended September, suggesting that global earnings have bottomed, the strategist wrote. “Investors should be able to look through further near-term downgrades,” since economic momentum is picking up, he added.

However, Schowitz warned that it is “too early to give the all-clear for risk assets,” given that trade talks could still fail and economic data improvement may not be sustained. The strategist’s least preferred areas are Australia and U.S. small-cap equities.

To contact the reporter on this story: Ishika Mookerjee in Singapore at imookerjee@bloomberg.net

To contact the editors responsible for this story: Lianting Tu at ltu4@bloomberg.net, Kurt Schussler, Naoto Hosoda

©2019 Bloomberg L.P.