(Bloomberg) -- JPMorgan Chase & Co.’s credit traders are shorting bonds of Adler Group, a real estate firm that has frequently turned to the lender’s investment bankers to help it raise billions of euros of debt.

Traders on the London credit desk of the U.S. bank started betting against the debt of the German-listed group in recent weeks, according to people familiar with the matter, who asked not to be identified because they’re not authorized to talk about the trade. The size of the position is unclear, they said.

The short has helped push Adler’s bonds to a record low this week, but doesn’t reflect the lender’s house view and may go against the strategy deployed by other desks of the investment bank, the people said.

The bet underscores how trading strategies and client relationships within a bank can often be at odds with each other as they vie to bring in revenue. Adler has been a long-time client and fee-generator for JPMorgan, which helped the real estate firm raise 4.5 billion euros ($5.3 billion) through a string of bond sales in the last four years and acted as global coordinator on its most recent bond issue in April.

JPMorgan was also the main adviser and helped finance a three-way merger between Adler Real Estate, ADO Properties and Consus Real Estate in 2020 that created Adler Group. The bank’s equity research desk is recommending clients to buy Adler’s shares as it targets a price of 32 euros apiece.

It’s not unusual for a large bank to be involved in multiple sides of a deal or trade, especially one with the global breadth of JPMorgan -- with trading desks running different strategies while deal arrangers, research teams and traders work separately.

A spokesperson for JPMorgan declined to comment. A spokesperson for Adler pointed to a S&P Global Ratings report published on Thursday that affirmed Adler’s rating two steps below investment grade with a stable outlook, but declined to comment ahead of the publication of first-half earnings.

New Target

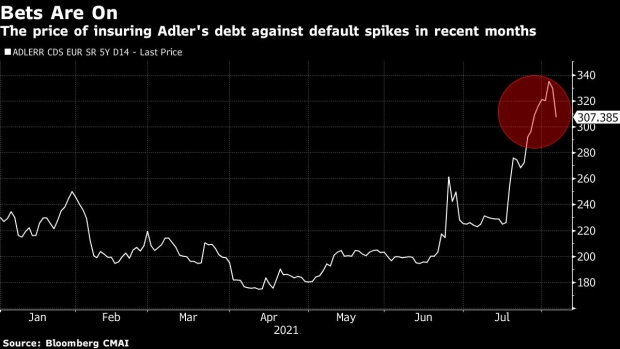

Adler’s bonds have been among the worst performers in Europe’s high-yield market in recent weeks, with its 800 million euro notes due 2029 falling to around 94% of their face value, the lowest since they were issued in January. The cost of insuring Adler’s debt touched all-time highs this week, climbing to 335 basis points, according to CMA data.

The bonds and CDS retraced some of their losses on Thursday, with the notes edging up around 1 cent on the euro after S&P published its report.

Adler is linked to Austrian businessman Cevdet Caner and has grown in recent years with debt-fueled acquisitions, racking up 8.4 billion euros of bonds and loans. The group owns more than 52,000 homes that are mostly concentrated in the regions bordering Berlin.

In September 2020, Caner was acquitted by a criminal court in Vienna over allegations including organized crime, fraud and money laundering. The prosecution stemmed from the collapse of Level One, Caner’s real estate firm that went bust more than a decade ago.

Adler’s shares and bonds plummeted in June on speculation that the company was about to become the latest target of renowned short-seller Fraser Perring. Even though he denied his involvement, the price of Adler’s debt never fully recovered.

CreditSights downgraded Adler’s bonds to “market perform” in late July, citing volatile trading in its shares and bonds, a lack of investor trust and a “couple of red flags.” Those included risks inherent in financial receivables used for debt reduction and the valuation of its development property portfolio, David Shnaps, a senior analyst, said at the time.

Meanwhile, investors have been taking bets against Adler’s shares, which are down 30% this year. Gladstone Capital Management has boosted its short position on Adler’s equity to almost 1% of the company’s stock. In total, 2.8% of its free floating shares are out on loan, according to Markit data.

Companies in the real estate sector have been a favorite bet among short sellers in Europe’s credit market in recent years due to concerns about cross ownership and asset valuations. Firms in the sector, especially across Germany, have been racing to raise debt at the fastest pace on record in recent years as yields remain low and investor appetite for riskier assets is strong.

(Adds detail about debt issuance of real estate firms in final paragraph)

©2021 Bloomberg L.P.