Jan 14, 2019

JPMorgan cuts loonie forecast as new NAFTA faces turbulence

, Bloomberg News

As current political turmoil in Washington threatens to bleed into the ratification of a new regional trade pact between the U.S., Mexico and Canada, JPMorgan Chase & Co. sees the Canadian dollar getting caught in the crossfire.

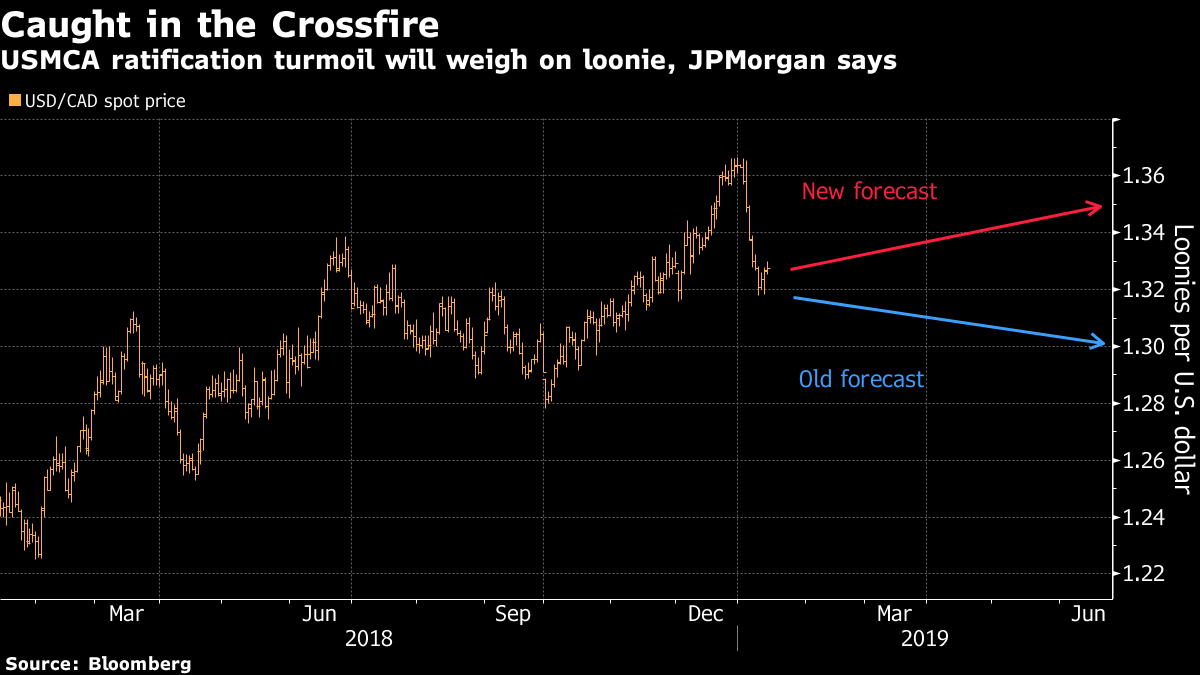

The bank now expects the Canadian currency to weaken to $1.35 per dollar by the middle of 2019, having previously forecast that it would be around $1.30. A key reason for the pessimism is the fraught outlook for the passage this year of the U.S.-Mexico-Canada Agreement, according to analysts Daniel Hui and Patrick Locke. Ratifying the pact will be “bumpier” than most investors realize given the deep fissures within a split U.S. Congress, as well as an ongoing partial government shutdown.

“The governing relationship between the Democrats and the Republicans is clearly off to a poor start,” Hui and Locke wrote in a Jan. 11 note. “The current dynamic portends major risks surrounding USMCA ratification, which market participants do not yet fully appreciate.”

The Canadian dollar tumbled almost 8 per cent against the greenback last year, the second worst performance among Group-of-10 currencies. A rebound in oil prices has helped the loonie strengthen about 2.8 per cent against the dollar this month to $1.3270. While JPMorgan expects the pair to touch $1.35 in the second quarter, the analysts believe the currency will finish 2019 at $1.29.

Hui and Locke forecast a 70 per cent chance that the trade pact is ratified in 2019, a 20 per cent chance that talks “muddle through” in 2020 and a 10 per cent chance that the deal collapses. While passage is the most likely outcome, JPMorgan warns that the process will be “noisy” and could see U.S. President Donald Trump initiate a withdrawal from the North American Free Trade Agreement in order to force a vote on USMCA.

“Such a scenario, which would trigger a six-month countdown before the actual withdrawal, would create a great degree of uncertainty,” Hui and Locke wrote. “The most likely path to that outcome is via contentious delays and ultimately withdrawal brinkmanship, the turbulence of which markets are not yet fully prepared for.”