Mar 20, 2023

JPMorgan, Deutsche Bank Win Epstein-Claim Dismissals

, Bloomberg News

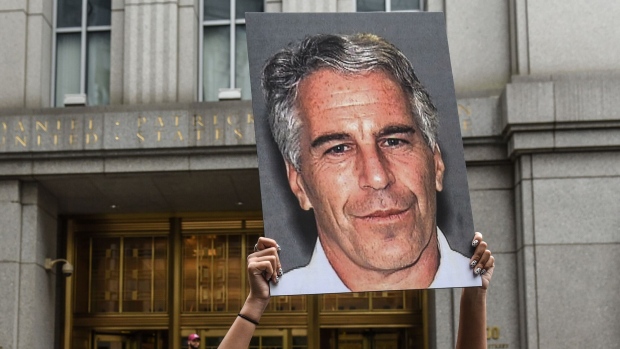

(Bloomberg) -- JPMorgan Chase & Co. and Deutsche Bank AG must still face lawsuits alleging that they knowingly benefited from Jeffrey Epstein’s sex-trafficking venture, but a judge threw out several of the claims against them.

US District Judge Jed Rakoff on Monday tossed the majority of the claims made against the banks in proposed class action suits filed by an Epstein victim identified only as Jane Doe. The Manhattan federal judge also threw out three of the four claims filed against JPMorgan in a separate suit by the US Virgin Islands.

Rakoff allowed Doe to proceed with several claims, including that the banks knowingly benefited from Epstein’s sex-trafficking scheme by providing him with financial services. Doe can also move ahead with a claim that the banks delayed charges being filed against Epstein by failing to report his suspicious financial activity earlier, the judge ruled.

But Rakoff dismissed Doe’s claims that JPMorgan and Deutsche Bank participated in Epstein’s crimes.

Rakoff didn’t provide the reasoning behind his four-page ruling, saying a fuller opinion would follow in due course. In the Deutsche Bank case, Rakoff dismissed eight counts but allowed four claims to proceed, including that the bank failed to exercise reasonable care to prevent physical harm. Rakoff threw out six of the 10 claims against JPMorgan.

Claiming Victory

In a joint statement on Monday, lawyers for Doe and the USVI called the decision allowing the case to move forward a victory.

“Epstein’s sex trafficking operation was impossible without the assistance of JPMorgan Chase, and later Deutsche Bank, and we assure the public that we will leave no stone unturned in our quest for justice for the many victims who deserved better from one of America’s largest financial institutions,” said Brad Edwards, one of Doe’s lawyers.

Spokespeople for JPMorgan and Deutsche Bank declined to comment.

The judge’s order clears the way for further discovery in the case. Mary Erdoes, JPMorgan’s asset and wealth management chief executive officer, was deposed earlier this month and former executive Jes Staley is due to face a two day deposition starting Thursday. JPMorgan has been fighting efforts to depose CEO Jamie Dimon.

Epstein was a client of JPMorgan between 1998 and 2013, and Doe alleges he used dozens of his accounts to pay off victims and cover the costs of transporting them to his properties. Doe says the bank gave Epstein access to large sums of cash to avoid triggering reporting requirements.

After JPMorgan cut ties with Epstein, most of his business went to Deutsche Bank up until 2018.

The financier was arrested for sex trafficking in 2019 but was found dead in his jail cell before he could go to trial.

‘Non-Routine Banking’

Rakoff’s ruling follows a hearing last week at which lawyers for JPMorgan argued that Doe hadn’t met the legal standard to show the bank knew or participated in Epstein’s sex trafficking.

JPMorgan contends that it merely provided routine banking services to Epstein, while Doe argued that he was afforded special treatment because he brought in wealthy clients. Rakoff has allowed her claims that JPMorgan failed to exercise reasonable care in providing “non-routine banking” to proceed. Doe alleges JPMorgan owed a duty to her because it chose not to investigate Epstein’s banking activities, which fell outside routine banking support.

Martina Vandenberg, president of the Human Trafficking Legal Center, said Rakoff’s ruling should be regarded as a win for the plaintiffs.

“It is very difficult to argue, to prevail that a third party was directly involved as a trafficker,” Vandenberg said. “That is a high bar. But the idea they knowingly benefitted from a venture means that they had some level of knowledge.”

The banks have long contended that they did not about Epstein’s crimes. Staley has emerged as a central figure in the claims against JPMorgan, with the Doe suit claiming that Staley “personally observed” sex-trafficking victims. Both suits argue that any knowledge by Staley should be imputed to JPMorgan as his employer.

Salacious details about Staley relationship with Epstein during his time at the bank have emerged in various court filings. The pair exchanged more than 1,200 emails, some of which referred to young women, Disney princesses and visits to Epstein’s private island in the US Virgin Islands.

JPMorgan has argued that Staley, who went on to become CEO of Barclay Plc before resigning in 2021 over his Epstein ties, acted outside the scope of his employment and they should not be held liable. In a further attempt to distance itself from Staley’s actions, the bank sued him on March 8, arguing he should be held liable for damages if any of Doe’s or USVI’s claims are proved true.

Staley, who was not named as a defendant by either Doe or the USVI, has previously denied involvement in Epstein’s sex-trafficking.

The cases are Jane Doe 1 v. JPMorgan Chase Bank, 22-cv-10019; Jane Doe 1 v. Deutsche Bank, 22-cv-10018, and USVI v. JPMorgan Chase Bank, 22-cv-10904-UA, US District Court, Southern District of New York (Manhattan)

©2023 Bloomberg L.P.