Mar 29, 2023

JPMorgan, Goldman Plan to Start Trading Private Credit Loans

, Bloomberg News

(Bloomberg) -- Wall Street banks are looking to start trading private credit loans as they seek to make inroads into the lucrative world of direct lending, a potential first step that could ultimately reshape the largely buy-and-hold market.

JPMorgan Chase & Co., Goldman Sachs Group Inc. and Barclays Plc are among the firms talking to private debt funds about facilitating secondary-market transactions, according to people with knowledge of the matter — with some banks reaching out directly to gauge manager interest. JPMorgan is using its own balance sheet to make markets amid an increase in client inquiries, said separate people familiar, who asked not to be identified because the details are confidential.

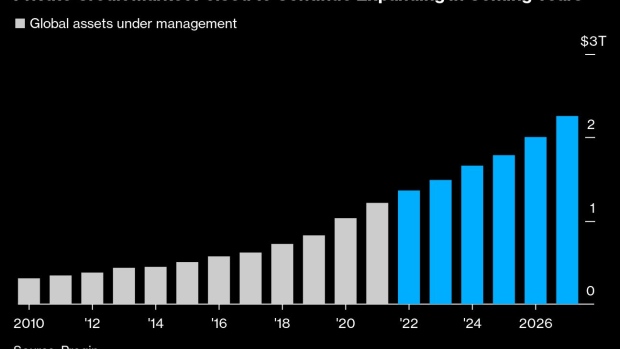

The foray is the latest effort by Wall Street to capture a slice of the $1.4 trillion private credit industry, where shops from Apollo Global Management Inc. to Blackstone Inc. often team up to make loans directly to companies. Proponents say secondary trading would help direct lenders better manage their portfolio mix, as well as free up capital to make new deals. But others warn that regular price discovery could force shops to mark down the value of their debt during periods of financial stress, increasing volatility.

The efforts are in the early stages, the people said, and it’s still unclear whether there’s sufficient interest among direct lenders for a robust secondary market to develop.

Representatives for JPMorgan, Goldman Sachs and Barclays declined to comment.

Private credit firms have been largely insulated from the pain elsewhere in markets over the past year. Direct loans are virtually all floating rate and held to maturity, allowing managers to shield portfolios from market tumult.

Yet the recent interest in offloading debt (beyond occasional one-off trades throughout the years) underscores how even they are being squeezed by higher borrowing costs and slowing growth, which have dented cash flows at portfolio companies and fueled an uptick in defaults.

Granted, there’s little sign that private credit firms are rushing to exit struggling loans. In fact, market watchers say those looking to trade out of positions will most likely do so to raise cash for new financings, which can generate hefty fees for lenders.

That’s especially true, they note, after macro volatility last year left some firms grumbling that weaker-than-expected fundraising and a slowdown in repayments from existing borrowers was forcing them to take smaller chunks of new deals.

Should market making take off, the likely windfall would help ease the sting for banks that have seen direct lending increasingly supplant the fee-rich high-yield bond and leveraged loan deals that until recently generated about a third of Wall Street’s investment-banking revenue.

“Banks want to trade it and make fees, and funds want to” have the option to exit positions, said Elaine Stokes, a portfolio manager at Loomis Sayles & Co.

Others aren’t convinced direct lenders are on board.

In addition to concerns over increased volatility, some say that secondary trading would ultimately erode the yield premium private credit commands over the high-yield bond and leveraged loan markets, given borrowers will no longer have the benefit of working with a small group of long-term lenders.

Market Evolution

While Goldman Sachs has yet to dedicate headcount to secondary private debt trading (the firm has a significant presence in the direct lending market via its asset management arm), JPMorgan already has a trader for buying and selling the loans, and is planning to grow further, according to people with knowledge of the situations.

Most of JPMorgan’s trades so far have been in the high 90 cent range, separate people familiar said.

The push comes as the New York-based bank also earmarks at least $10 billion of its own money for direct lending.

JPMorgan recently offered to take a small piece of a $5.5 billion direct loan that private credit firms have proposed for Carlyle Group Inc.’s acquisition of a stake in Cotiviti Inc., after struggling to drum up interest for a traditional debt deal that would ultimately be syndicated to third-party investors.

For more, check out the Private Credit Weekly

For Loomis Sayles’s Stokes, there could be little difference between the two in the coming years.

The growth of private credit, which is now roughly the same size as both the high-yield bond and broadly syndicated leveraged loan markets, is prompting increasing demand for secondary liquidity. That’s only being accelerated by market stress, she added.

“Basically private credit is becoming more and more like high-yield bonds and leveraged loans,” Stokes said.

©2023 Bloomberg L.P.