Oct 13, 2020

JPMorgan posts surprise jump in profit on lower credit costs

, Bloomberg News

Big U.S. bank stocks becoming more attractive: JonesTrading chief strategist

JPMorgan Chase & Co., in its third quarter under the shadow of the pandemic, showed that the surge in trading is holding up -- and so are borrowers.

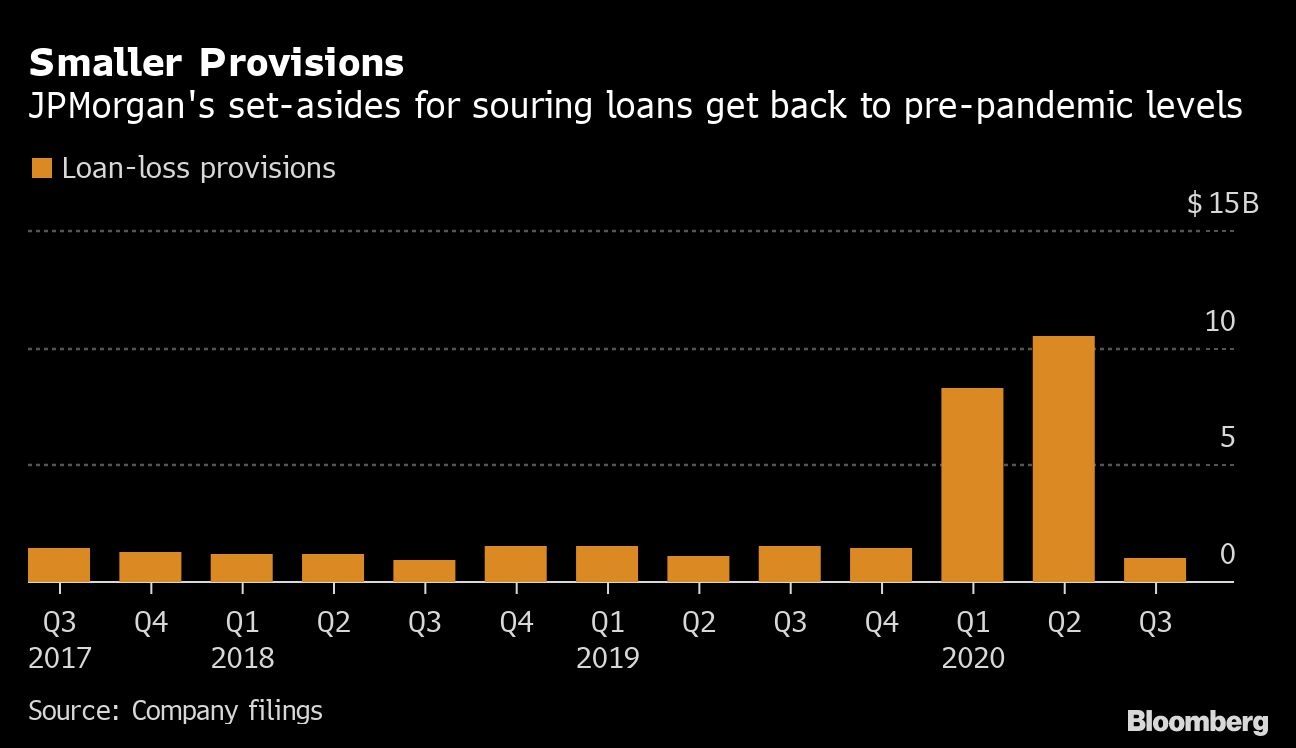

The biggest U.S. bank posted a surprise increase in earnings, fueled by a 30 per cent jump in markets revenue as elevated volume kept its stock and bond traders busy. The lender also defied expectations by cutting its reserve for credit losses by US$569 million, after adding US$20 billion to the allowance in the first half, as charge-offs of bad loans declined from a year earlier.

Those improvements and a nine per cent gain in investment-banking fees led to the most profitable quarter of 2020.

“The corporate and investment bank continues to be a big driver of firm performance,” Chief Executive Officer Jamie Dimon said in a statement Tuesday. “We maintained our credit reserves at US$34 billion given significant economic uncertainty and a broad range of potential outcomes.”

The COVID-19 pandemic has wreaked havoc on the global economy, and bank investors have been waiting to see how much that translates into losses from soured loans. Delinquencies have remained low so far, helped by lenders’ forbearance programs and government stimulus efforts, but executives have warned that the effects could drag on for years.

JPMorgan’s earnings hint at what’s to come when the rest of Wall Street reports results this week. The bank’s report indicates that the nation’s four biggest lenders probably won’t set aside the $10 billion of additional loan-loss provisions that analysts had expected for the third quarter.

In releasing some of its credit reserves, JPMorgan is signaling more optimism about the outlook for the economy than it did just a few weeks ago. The bank lowered its year-end forecast for U.S. unemployment to 9.5 per cent from 10.9 per cent in the second quarter, and expects the figure to fall to 7.3 per cent by the end of next year.

More than half the consumer loans that were in payment deferral at the end of the second quarter have exited those plans, with US$29 billion of balances remaining at the end of September. About 92 per cent of accounts that came out of deferral programs are current on their payments, the bank said.

The bank said material losses in its consumer portfolio probably won’t show up until the second half of next year, later than initially anticipated.

Piepszak said the economy would have to improve in line with the bank’s base case for the firm to consider releasing reserves in future quarters, cautioning that while the “consumer is in really good shape, there is a significant amount of uncertainty about what we may see next.”

Shares of the company, which have declined 27 per cent this year, slipped 0.3 per cent to US$102.14 at 9:49 a.m. in New York.

Piepszak said the economy would have to improve in line with the bank’s base case for the firm to consider releasing reserves in future quarters, cautioning that while the “consumer is in really good shape, there is a significant amount of uncertainty about what we may see next.”

JPMorgan lowered its estimate for the U.S. economic contraction to 5.4 per cent in the fourth quarter from a previous estimate of 6.2 per cent.

Chief Financial Officer Jennifer Piepszak said in September that the bank’s third-quarter trading revenue would probably jump 20 per cent from last year. The firm surpassed that as its US$6.6 billion total was higher than the US$6.15 billion analysts were expecting.

Profit climbed 4 per cent to US$9.44 billion from US$9.1 billion a year ago. The New York-based bank took a one-time charge to help cover the cost of a US$920.2 million fine to resolve U.S. authorities’ claims of market manipulation by its precious metals and Treasury markets trading desks. JPMorgan previously said it had set aside about half of what it needed for the fine.

Net revenue was flat from last year as a seven per cent increase in fee income was offset by lower lending income. The bank maintained its full-year outlook for net-interest income of US$55 billion, and said annual expenses would be about $66 billion, in line with the outlook provided a month ago.

JPMorgan also extended a suspension on stock buybacks through at least the end of the year, citing the Federal Reserve’s unprecedented requirement that major U.S. lenders halt repurchases for now.

Dimon said on a conference call that the bank has an “extraordinary” amount of excess capital.

“You could buy back stock and still be conservatively reserved,” Dimon said. “I hope we’re allowed to do it before the stock is much higher.”

Other Key Results:

- The reserve for credit losses was still almost US$34 billion, as the bank said in September it was expecting loan defaults to surge in the first half of next year as the effect of the government’s stimulus measures starts to wear off.

- Net charge-offs fell to US$1.18 billion, 24 per cent lower than in the second quarter and 14 per cent below the same period last year. The charge-offs were predominantly driven by the credit-card portfolio. The bank said its net reserve release was driven by the “run-off in the home-lending portfolio and changes in wholesale-loan balances.”

- The total provision for credit losses was US$611 million, 94 per cent lower than the second quarter and far below than the US$2.38 billion analysts had estimated.

- Net interest income fell nine per cent to US$13.1 billion. Analysts were expecting it to drop six per cent.

- The firm’s investment bankers generated US$2.2 billion advising on mergers and underwriting stock and bond offerings, nine per cent more than last year and more than analysts were expecting. A rebound in IPO activity helped JPMorgan’s equity capital-markets bankers generate US$732 million, their best third quarter ever.