Mar 27, 2023

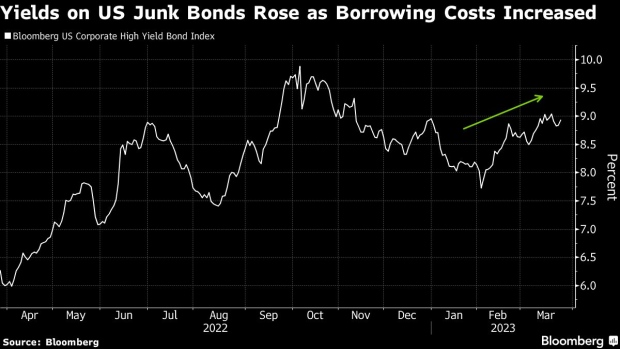

JPMorgan’s Coleman Favors Junk Bonds If There’s a US Recession

, Bloomberg News

(Bloomberg) -- JPMorgan Asset Management likes high-yield bonds in the event of a US recession, hoping to stock up cheaply on sectors that would outperform once the economy returns to growth.

The comments by Lisa Coleman, head of investment grade credit, offer insight into how the firm plans to deploy its funds should the long-feared hard landing for the economy finally materialize. The US bank bought utility company bonds last week as part of “small adjustments” to its portfolios.

“I would expect us to try and find opportunities in the BB high-yield space to add exposure when the time is right,” Coleman said in an interview during a visit to Australia this week. “But spreads need to widen and there needs to be more decompression of spreads between investment grade and high yield to want to do that.”

- In the event of a recession, the institution would add “cyclical sectors — metals and mining, autos — those areas we would expect to improve on a cyclical upswing”

- Is keen to buy investment grade debt from global systemically important banks

- “What is interesting is that during this period of volatility, the G-SIBS have held in very well”

- Expects the yield from additional tier 1 bank bonds to increase after Credit Suisse Group AG’s bondholders got wiped out

- “If you’re going to be an AT1 investors, you have to expect this is one of the risks.”

--With assistance from Tassia Sipahutar.

©2023 Bloomberg L.P.