Mar 14, 2019

JPMorgan's Kolanovic Says Time to Get Over Your Fear of Stocks

, Bloomberg News

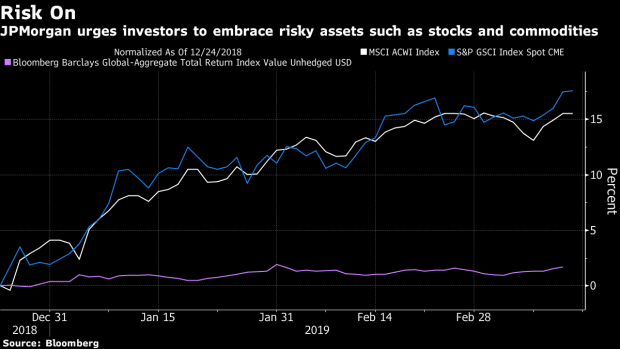

(Bloomberg) -- Investors who have shunned risky assets since Christmas better start embracing them, according to JPMorgan Chase strategists led by Marko Kolanovic.

The firm advised clients to boost holdings in commodities and cut exposure to safer assets such as government bonds. A U.S.-China trade agreement appears likely and major central banks around the world have adopted a more dovish stance, all setting the stage for an economic rebound in the second half of 2019, the team said.

“Since risky assets tend to price in forward looking fundamentals, we believe markets are likely to look through the soft patch and increasingly price in the H2 growth rebound, particularly if we see a resolution to the US-China trade dispute,” the strategists wrote in a note to clients. “These developments should provide a tailwind for risky assets.”

Investors have stuck to a defensive stance despite a market bounce that’s driven the S&P 500 Index up 20 percent from its December low. Hedge funds and computer-driven traders, for instance, saw their equity exposure only at the 25th percentile relative to history, JPMorgan data showed.

One reason money managers may be cautious involves the uncertainty surrounding trade. A meeting between President Trump and President Xi Jinping to sign an agreement to end their trade war won’t occur this month and is more likely to happen in April at the earliest, three people familiar with the matter said earlier.

Once the risk is out of the way, JPMorgan expects money to flow back to stocks, helping extend the advance.

“Equity positioning is still light as many investors remain on the sideline since the Q4 sell-off, awaiting confirmation of the U.S./China trade deal,” the strategists wrote. “Re-leveraging by systematic and fundamental investors should act as a tailwind and support further market gains.”

To contact the reporter on this story: Lu Wang in New York at lwang8@bloomberg.net

To contact the editors responsible for this story: Courtney Dentch at cdentch1@bloomberg.net, Scott Schnipper

©2019 Bloomberg L.P.