Dec 1, 2021

JPMorgan Says Buy the Dip as Omicron May Signal Pandemic Ending

, Bloomberg News

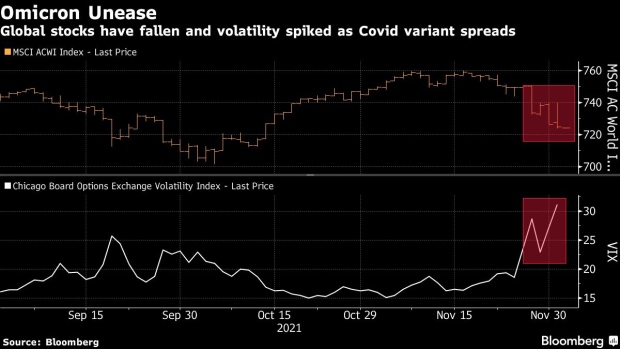

(Bloomberg) -- The recent market turmoil caused by the emergence of the omicron virus strain may offer investors a chance to position for a trend reversal in reopening and commodity trades, according to JPMorgan Chase & Co.

While it is likely that omicron is more transmissible, early reports suggest it may also be less deadly, which would fit into the pattern of virus evolution observed historically, strategists Marko Kolanovic and Bram Kaplan wrote in a note Wednesday. This might ultimately be a positive for risk markets because it could signal that the end of the pandemic is in sight, they said.

“Omicron could be a catalyst for steepening (not flattening) the yield curve, rotation from growth to value, selloff in Covid and lockdown beneficiaries and rally in reopening themes,” the strategists said. “We view the recent selloff in these segments as an opportunity to buy the dip in cyclicals, commodities and reopening themes, and to position for higher bond yields and steepening.”

The emergence of the new virus strain has roiled markets in recent days, with countries around the world stepping up travel restrictions. While some health officials said it could take weeks to reach a verdict, Australia’s Chief Medical Officer Paul Kelly said there is no indication that it is more deadly than other strains.

It would fit with historical patterns for a less severe and more transmissible virus to quickly crowd out more severe variants, which could turn omicron into a catalyst to transform a deadly pandemic into something more akin to seasonal flu, the JPMorgan strategists wrote.

“If that scenario were to happen, instead of skipping two letters and naming it omicron, the WHO could have skipped all the way to omega,” -- the last letter of the Greek alphabet -- the strategists said.

©2021 Bloomberg L.P.