Oct 14, 2020

JPMorgan Strategists See ‘Modest’ Headwind for Bitcoin Price

, Bloomberg News

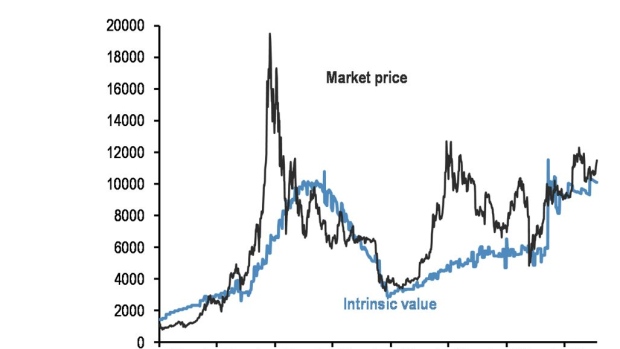

(Bloomberg) -- Bitcoin faces a “modest headwind” in the short term based on an analysis of bets in the futures market and an estimate of the cryptocurrency’s intrinsic value, according to JPMorgan Chase & Co.

A positioning indicator derived from futures shows that “there still appears to be an overhang of net long positions,” strategists including Nikolaos Panigirtzoglou wrote in a note Tuesday. A drop in Bitcoin in September eliminated much “froth” but it remains about 13% higher than an estimate of intrinsic value, they said.

Bitcoin slid over 8% last month but held above the $10,000 level and has since rallied back past $11,000. While cryptocurrencies have had a volatile year, the Bloomberg Galaxy Crypto Index of digital coins has surged more than 80%, turning the sector into one of this year’s best performing asset classes.

The JPMorgan strategists said they calculated an intrinsic value by effectively treating Bitcoin as a commodity and looking at the marginal cost of production. They also said corporates are emerging as a source of demand, after payments firm Square and technology company MicroStrategy made significant purchases.

©2020 Bloomberg L.P.