Mike Cagney’s Figure Technology Taps Tannenbaum as Its New CEO

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Figure Technology Solutions Inc. tapped Michael Tannenbaum as its new chief executive officer, ahead of the financial-services firm’s potential initial public offering.

Sales of new homes in the US bounced back broadly in March as an abundance of inventory helped drive prices lower.

Hong Kong developer Lai Sun Development Co. is considering options for a planned office tower in the City of London, including a potential sale of a stake in the project.

Germany’s financial regulator BaFin is taking a closer look at the real estate used by lenders to secure covered bonds known as Pfandbriefe, a €400 billion market traditionally considered among the safest in credit.

Taylor Wimpey Plc is failing to see lower mortgage rates translate into higher levels of home sales and is maintaining its forecast for fewer deals in 2024.

Jul 12, 2018

, Bloomberg News

(Bloomberg) -- Bank shares have been underperforming the broader market since May, when 10-year Treasury yields peaked, capping expectations for a boom in bank profits driven by rate hikes. With tax cuts in the rear-view mirror and de-regulatory efforts slowing, bank investors may put a fresh emphasis on fundamentals, particularly lending, when JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co. kick off earnings reports Friday morning.

The quarter’s loan growth and the outlook for more — or less — "may be the most interesting variable across banks," Bloomberg Intelligence analyst Alison Williams says. She cites "broadly declining optimism," though commercial and industrial (C&I) lending is showing "a better trend."

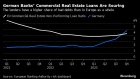

The Bank of the Ozarks disappointed investors on Thursday, with a warning that competitors in commercial real estate are getting more aggressive with credit structures and pricing, along with pressure on its net interest margin. Shares in the lender sank more than 9%, leading the KBW index of regional banks to its steepest intraday decline since May 29. The broader KBW Bank Index was little changed at 1:30 p.m. in New York.

When JPMorgan’s report hits, around 7 a.m., Credit Suisse analyst Susan Roth Katzke will be most focused on "the macro outlook," including GDP growth and its implications for interest rates, loan demand and credit quality. She’ll also be watching the capital markets environment, including whether June’s momentum can continue, and gauging competition in loan and deposit pricing. Last quarter, JPMorgan said it expected average core loan growth of 6 percent to 7 percent, excluding CIB loans, in 2018.

An in-line quarter might be good enough to boost lagging bank shares across the board, Goldman Sachs analyst Richard Ramsden wrote earlier this week. He said loan growth may stay unchanged from first-quarter levels at 3 percent, despite optimism about post-tax overhaul and a C&I loan rebound, and noted bank management teams now expect tax tailwinds won’t happen until the second half of this year.

Mike Mayo, an analyst at Wells Fargo, will be looking for the "dessert" bank investors had hoped for earlier this year. Loan growth during the second quarter "may appear only modest but period-end loans should show a strong pick-up, giving new signs of green shoots," Mayo writes in a note.

"Capital markets could still benefit from added volatility," Mayo added, while the industry seems to be on the cusp of record capital return, and "mergers should be good too." He also expects a 25-year "structural break-out for the benefits of scale that should take the industry to record efficiency."

KBW has "a sunny outlook" on banks, with fundamentals supporting outperformance once geopolitical risks dissipate, analyst Brian Kleinhanzl writes in a note. He sees a second-quarter pick-up in C&I loan growth, even as investor expectations have been coming down. That could set up stocks for gains.

Not so fast, says Raymond James’s David Long, who wrote that loan growth and net interest margin outlooks for the second half of the year are at risk, even as the latest round of results will likely be solid, buoyed by rate hikes, seasonal shifts in mortgage banking and compensation expenses, and relatively benign credit trends.

Ahead of the second-quarter earnings season, banks including Bank of America Corp. were "pretty aggressive in reining in" net interest income growth prospects, Portales Partners’ Charles Peabody says in an email to Bloomberg News. That’s "partly because loan growth has been more sluggish than expected."

Peabody expects some pickup in the year’s second half, though on July 9 he suggested investors "sell the next rally," as banks have probably passed peak EPS and profitability, and "the time to have sold these stocks was during the run-up to the tax-cut mania in late 2017/early 2018."

Wells Fargo has a unique set of challenges among big banks, as it struggles inside the Federal Reserve’s penalty box. In addition to keeping an eye on the bank’s core loan and deposit growth, Credit Suisse’s Susan Roth Katzke will be watching how the San Francisco-based bank is managing its balance sheet given the Fed’s asset cap limitation. She’ll also be looking for updates about investigations, litigation and broader regulatory reform dynamics, including next year’s Fed stress testing.

Bottom line, Credit Suisse expects Wells Fargo to report lower revenue than last quarter and the year-ago period, amid business unit exits, portfolio sales and portfolio de-risking. Additionally, "challenging" fee revenue comparisons, including service charges and equity investments, may be another barrier.

JPMORGAN ESTIMATES

CITIGROUP

WELLS FARGO

BANK OF AMERICA

GOLDMAN SACHS

MORGAN STANLEY

--With assistance from Karishma Motwani, Laura J. Keller, Emma Kinery and David Ingold.

To contact the reporters on this story: Felice Maranz in New York at fmaranz@bloomberg.net;Austin Weinstein in New York at aweinstein18@bloomberg.net

To contact the editors responsible for this story: Catherine Larkin at clarkin4@bloomberg.net, Jeremy R. Cooke, Steven Fromm

©2018 Bloomberg L.P.