Jul 22, 2019

Julius Baer's Slowest Inflows in Years Cap Hodler's Tenure

, Bloomberg News

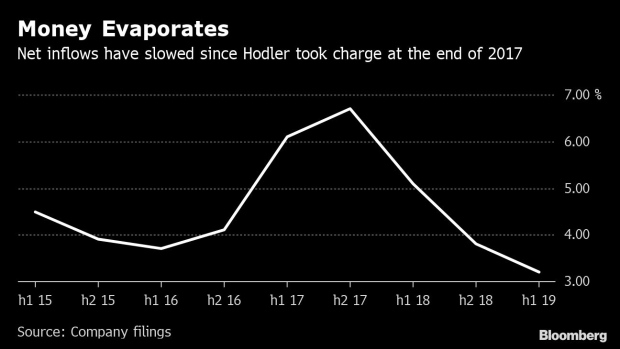

(Bloomberg) -- Julius Baer Group Ltd. reported the lowest inflows in at least seven years, leaving outgoing Chief Executive Officer Bernhard Hodler’s successor with plenty to fix.

Net new money grew by 3.2% in the first half and the bank missed a medium-term goal of 4% to 6% growth. The number of relationship managers responsible for bringing in new client money, declined from the end of 2018.

This is Hodler’s last earnings report at the helm of Julius Baer. Promoted to CEO after the shock departure of Boris Collardi about one and a half years ago, the former compliance chief helped clean up Switzerland’s third-biggest private bank after a money laundering scandal cast a shadow over a rapid expansion under his predecessor.

"I think I did more than just care-taking,” Hodler said in a Bloomberg TV interview with Manus Cranny. “We stabilized the firm, we calmed down the market. We started to really work on the core markets quite heavily."

Kairos Outflows

Julius Baer was hit by outflows from Kairos, an Italian subsidiary that its trying to sell. The group’s net new money was also hurt by the exits of some clients, as it purges risky accounts, and by a wider application of negative interest rates to large cash holdings, mainly Swiss francs and euros.

Rising stock values helped boost assets under management to 412 billion Swiss francs ($412 billion). Larger Swiss rival UBS Group AG is due to report second-quarter earnings tomorrow.

Philipp Rickenbacher, a little known Julius Baer veteran, will take over as CEO in September in a move likely to be another step back from the breakneck expansion under Collardi. Earlier this year, the company set less ambitious targets for its pretax margin and cost-to-income ratio and pledged to cut annual costs by 100 million francs.

(Adds comment from Julius Baer CEO, chart from fourth paragraph.)

--With assistance from Manus Cranny.

To contact the reporter on this story: Patrick Winters in Zurich at pwinters3@bloomberg.net

To contact the editors responsible for this story: Dale Crofts at dcrofts@bloomberg.net, Ross Larsen, Shaji Mathew

©2019 Bloomberg L.P.